Southern Aurora Markets partner Mike Avery.

WHAT a difference a week makes, in another week of wool auctions dominated by global sentiment and rhetoric, but with an outcome that was far different.

The second last wool auction week of the year saw prices lift on average between 3-4 percent.

A far cry from the headline-grabbing comments from some sections of the media about the doom and gloom in wool prices. Wool has not been immune from the ills of international markets with logistical, financial, energy and inflation pressure common to all along commodity pipelines.

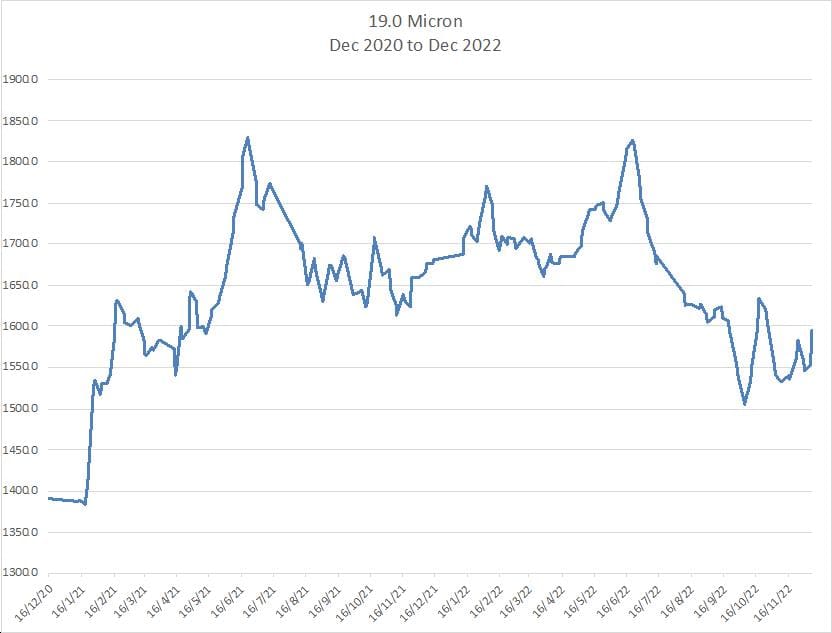

The overall positioning of wool as a desirable, eco-friendly natural fibre will come to the fore once the headwinds have been overcome. The update of last week’s chart highlights the volatile nature of spot prices over recent times.

The overall negative trend and subsequent volatility had the forward markets in virtual hiatus. Trading volumes have been dismal for the last three months as exporters were unable to deliver what sellers saw as fair value. Demand signals have been muted by ongoing COVID restrictions. Some positive indications lifted spot prices and this prompted activity on the forward markets.

More than 100 tonnes of wool was traded for the week, with the focus of the volume in the nearby three-month window as exporters could match grower expectations. The 19 micron contract traded to a high of 1600 cents in January and 1560 cents out to the middle of the year. Bidding remains solid (1560 cents) all through 2024. The 21 micron contract also found support out to May 2023 at 1300 cents.

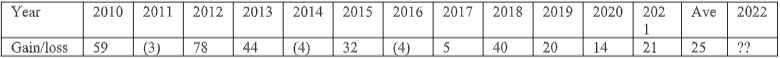

We will likely see a steadier close after what was the most positive week for the season to date. This price movement is not uncommon. The table below illustrates the price change from end November to the recess for 19 microns.

Over the last twelve years, the worst case scenario has been a relatively flat December. Most years show a modest gain as exporters complete orders and mills look to balance stock ahead of the recess. The 50-cent gain this week may indicate that buyers have looked to complete their orders and balance their books a little earlier with the logic challenges. They have also looked to hedge a little more forward rather than carry stock as increased interest rates combined with longer cycle time from purchase to payment from the end user is stretching even the most efficient exporter.

Trades this week

December 2022 19 micron 1580 cents 2.5 tonnes

December 2022 21 micron 1335 cents 2.5 tonnes

January 2023 17 micron 2155 cents 4.5 tonnes

January 2023 19 micron 1540/1600 cents 35 tonnes

January 2023 21 micron 1300 cents 5 tonnes

February 2023 17 micron 2105 cents 5 tonnes

February 2023 19 micron 1560 cents 10 tonnes

February 2023 21 micron 1300 cents 10 tonnes

March 2023 19 micron 1560 cents 5 tonnes

March 2023 21 micron 1300 cents 5 tonnes

April 2023 21 micron 1300 cents 5 tonnes

May 2023 21 micron 1300 cents 5 tonnes

January 2024 19 micron 1550 cents 10 tonnes

Total 104.5 tonnes

HAVE YOUR SAY