Southern Aurora Markets partner Mike Avery.

WOOL auctions returned after the Easter recess with anticipation the market would struggle under the weight of 60,000 bales on offer.

The forward market traded in limited volumes during the recess at levels that supported that fragile view but only at modest discounts.

Buyers and sellers seemed more concerned about balancing their positions or guaranteeing some margin certainty with most trades going through at a 1-2 percent discount to the close.

The week played out as the forward market predicted. Tuesday auctions opened with most finer micron qualities losing between 20 and 30 cents. Medium qualities down only 5 to 10 cents.

On Wednesday, the trend continued but support was beginning to appear with Fremantle closing on a stronger note. That firmer tendency continued into the conclusion of auctions on Thursday.

The forward market was relatively quiet as the spot auction market searched for a base. Buyers paid above cash to get cover, but sellers generally remained patient as prices grind towards historic support levels.

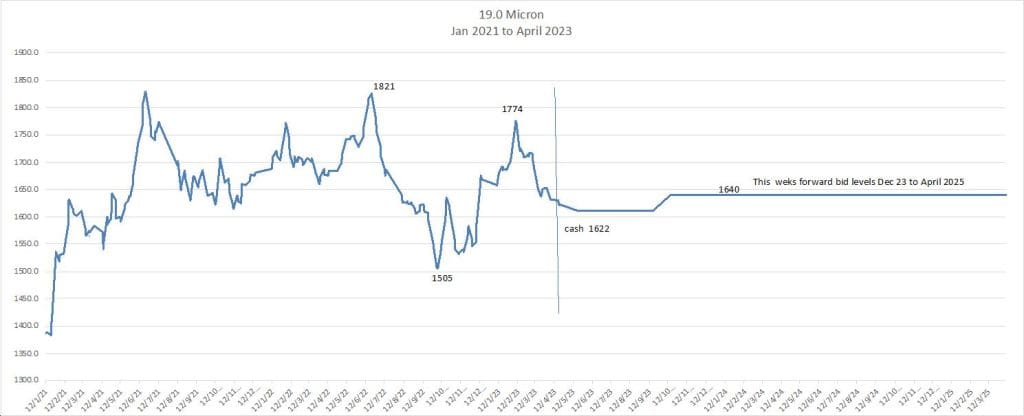

The forward bidding on the 19 micron contract is currently 20 cents above spot at 1640 cents, providing food for thought for growers looking for some insurance out as far as April 2025.

A lighter supply of 45,000 bales will not drive the direction of the market next week. Sentiment and the macro-economic outlook will have the principal impact.

Globally, soft commodities had a mixed week, with cotton down 3pc on close of trade Thursday.

We are unlikely to see a major change on the wool front, with exporters looking to hedge at best around cash in the nearby and into Spring, but still providing modest long-term cover (2024/25) at a 1pc premium.

Post-Easter forward trades

April 19 micron 1605 cents 5 tonnes

April 21 micron 1385 cents 5 tonnes

April 28 micron 325 cents 5 tonnes

May 19 micron 1600 cents 10 tonnes

May 19.5 micron 1525/60 cents 10 tonnes

May 21 micron 1395/1400 cents 20 tonnes

Total 55 tonnes

HAVE YOUR SAY