Southern Aurora Markets partner Mike Avery.

FORWARD wool markets offered opportunities in a less dramatic week for Australian auction sales.

Spot prices continued to slip this week, losing around 1 to 2 percent in auctions on Tuesday.

A higher passed-in rate helped to stabilise the market into the close on Thursday, with buyers required to push higher to meet their shipping obligations.

The forward markets once again offered opportunities early in the week as buyers looked to get some cover on anticipation that the stronger USD might stimulate the market. The limited offering was snapped up at levels that exceeded the closing spot. The 19 micron contract traded at 1735 cents and 21 micron was at 1495 cents in the prompt window.

In the Spring, 28 micron traded at full carry (interest plus storage) with 20 tonnes executed at 415 cents and 420 cents for September and October maturity. With the spot market disappointing again, bids pulled back and with them hedging opportunities.

Buyers have reset their levels around 1-2pc under spot for the prompt window. Whether we see improvement on these prior to the open of the auction series will rely solely on the short-term offshore demand signals.

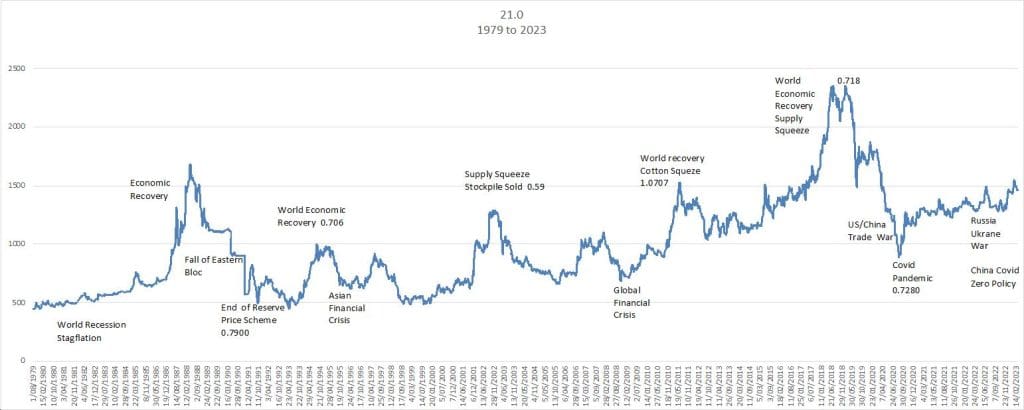

Auction supply remains high with over 50,000 bales again rostered for next week. The USD strength will help but not drive the market. As the graph below highlights, price is generally determined by macro events that drive demand.

Trying to predict the future is always fraught with danger and this is the core reason forward markets have a role. Up to date data is fundamental in helping to get a clearer picture of where prices might be heading and therefore the extent of the risk that needs to be managed.

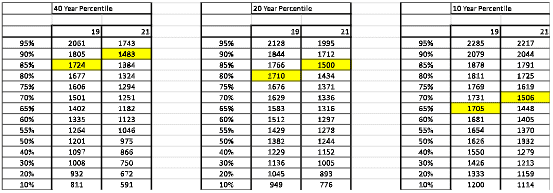

The percentile tables below highlight where we are sitting historically for prices. The timeframe is important when assessing what is more suitable to the individual enterprise.

The Wool Learning Centre has recently added a Price Risk Management Course to it’s library and can be accessed on the link here.

This week’s trades

March 19 micron 1735 cents 5 tonnes

March 21 micron 1475/95 cents 13 tonnes

April 21 micron 1455 cents 5 tonnes

September 28 micron 415/20 cents 10 tonnes

October 28 micron 415/20 cents 10 tonnes

Total 43 tonnes

HAVE YOUR SAY