THE forward wool market remained relatively quiet this week, with sellers unwilling to lock in at prices that look uncompetitive to the last few seasons.

It was another interesting week on the spot and forward markets, with volatility continuing to hamper the market and the orderly flow of wool through the pipeline.

The impact on the apparel supply chain of COVID-19 has been severe, unprecedented and ongoing.

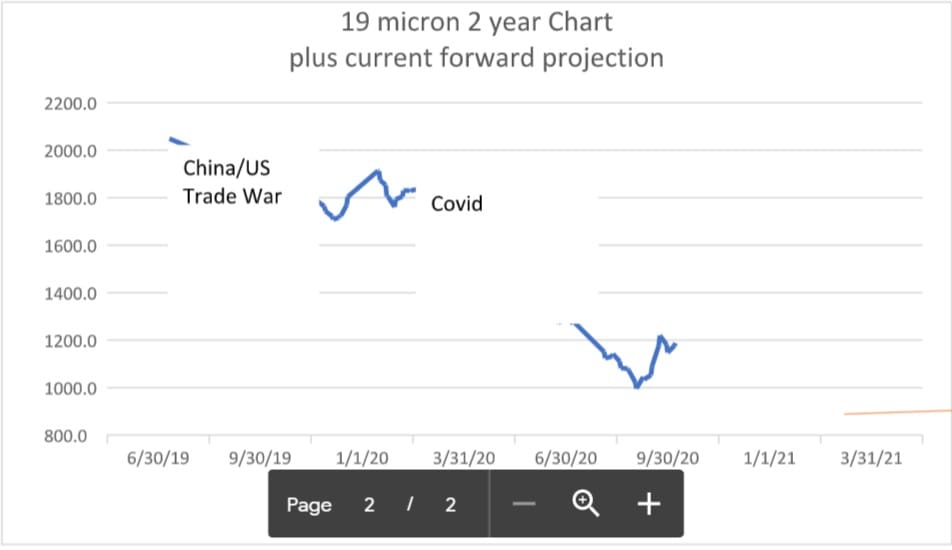

The outcome has delivered season opening that saw prices fall over 30 percent to lows in early September of 996 cents on the 19 micron index and 883 cents on 21.0 micron.

Recovery through the back half of September has seen prices lift in the spot auction and forward markets, yet it has been anything but a smooth ride, with prices rising 20pc in a fortnight, only to give back 6pc last week.

Something akin to stability returned this week with prices gaining around 2pc in the auction.

Possibly more important was an absence of a discount in the forward markets. The 19 micron index traded at 1200 cents for January 2021 (cash 1188 cents) and the 21 micron index in October is at 1035 cents (cash 1028 cents).

All microns are currently bid flat to cash or at a slight premium out until June 2021. Buyers are looking to take on some risk at these levels and use forwards to partially offset in this volatile and unpredictable landscape.

Growers need to be part of this risk mitigation along the pipeline. Whether this is the time or price level is up to the individual’s appetite for risk, their current hedge position and strategy to manage margin.

Going forward, we see a similar pattern of short-term rallies and pullbacks. The medium-term direction will be controlled by macro-economic forces dominated by scientific and political outcomes over the coming months. Whether the market has found a base at current levels is up for debate.

What appears more likely is that a restoration of normal pipeline conditions and a return to an upward price cycle could be 12 months or more away.

The forward market is likely to stay flat ahead of next week’s auction with buyers happy to cover any short-term demand.

Trade summary

October 18 micron 1355 cents 5 tonnes

October 21 micron 1035 cents 20 tonnes

January 19 micron 1200 cents 5 tonnes

TOTAL 30 tonnes

Indicative trading levels next week

19 micron 21 micron

October 1190 cents 1035 cents

Nov/December 1190 cents 1030 cents

Jan/February 1190 cents 1030 cents

Mar/April 1195 cents 1035 cents

May/June 1200 cents 1030 cents

HAVE YOUR SAY