IT was an interesting week on the wool forwards market.

IT was an interesting week on the wool forwards market.

Volume was moderate in a week where unprecedented spring levels where paid.

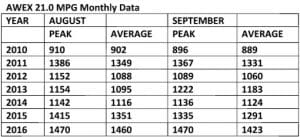

Growers had to accept discounts to the spot market of 50 to 100 cents to achieve hedging levels of 1500 cents in August and 1450 cents in September. Although 3 percent and 6pc discount seems on the face of it to be steep, but in the light of current volatility, record high prices and historical data in, it makes more sense.

Not unexpectedly the market falls into the spring in most years on higher supply. What is welcomed from these figures is that currently August and September hedging levels are at or exceeding historical auction peaks. In dollar terms for 21.0 micron fleece, this is over $1800 per bale.

The longest dated contract this week was 1425 cents for December, or around $1780 for a 125kg clean bale.

It remains a challenging time for all participants along the pipeline. Exporters are facing historically high variations from auction spot to forward level (if any) being shown offshore. Processors are reporting demand contraction at these levels and only moderate stock take up. For the grower the difficulty is assessing what is the appropriate level to commence or continue a hedging program.

The forward market has been demanding discounts. This has proved unrealistic, as the spot market, although volatile, has been on an upward track for 18 months. At current levels it might be more prudent to look at return levels per bale rather than the discount as the price risk level rises. Alternatively, options may be a strategy. At current volatility it will be necessary to look at a moderate strike price to achieve an acceptable premium.

It is probably appropriate at these peak levels that ‘the value of certainty is more important than the fear of lost opportunity.’

Next week we expect forward prices to contract a little ahead of the spot auction. Exporters are still looking for some off shore demand signals as most mills continue a wait-and-see approach.

Anticipated levels next week

July 19 micron 1820 to 1850 cents

21 micron 1500 to 1540 cents

August 19 micron 1780 to 1830 cents

21 micron 1450 to 1490 cents

September 19 micron 1710 to 1750 cents

21 micron 1430 to 1460 cents

October 19 micron 1680 to 1710 cents

21 micron 1400 to 1430 cents

Trade summary

August 19 micron 1850 cents 22.5 tonnes

August 21 micron 1500 cents 15 tonnes

September 21 micron 1438/1450 cents 47 tonnes

December 21 micron 1425 cents 7 tonnes

Total 91.5 tonnes

HAVE YOUR SAY