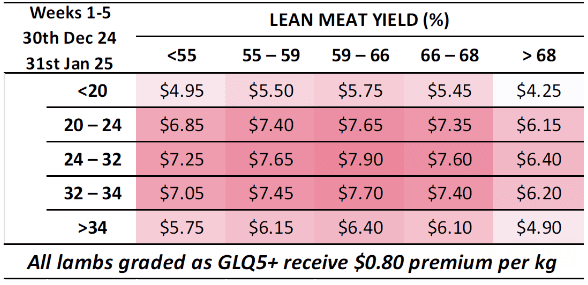

Gundagai Lamb December-January forward lamb price grid. Image – Gundagai Lamb.

LAMB producers are enjoying bouyant processor, store and forward demand for lambs – including a grid for superior eating quality carcases — as the industry heads into an expected reduced and later turn-off of new season slaughter lambs this season.

Several processors have current forward contracts on lambs that have given producers some security, and helped spur increased feedlot demand for store lambs in saleyards, sometimes outcompeting trade and light export lamb processors.

Thomas Foods International put out a October-November delivery contract to Lobethal and Stawell for 20.1+kg new season crossbred lambs at $7.60-$8 a kg, with a 30 cent discount for Merinos. The old crossbred 24.1-32kg lamb contract varied from $7.40-$7.80 a kg, with a 20 cent discount for Dorpers and a further 10 cents discount for Merinos.

The JBS Brooklyn and Bordertown contract for mid-October to late November delivery for farm assured new season 20-31.9kg lambs from accredited suppliers only varied from $8-$8.40 a kg and $7.80-$8.20 a kg for NSL lambs from non-accredited producers. The accredited supplier old crossbred lamb grid ranged from $7.80-$8.20 a kg and from $7.60-$8 a kg for old crossbred lambs from other suppliers. It contained a warning that kill space can close at any time without notice.

Gundagai offers first forward eating quality contract

Gundagai-based processor Gundagai Lamb this week offered its first forward contract for producers with a proven track record for producing high eating quality carcases, after running a small-scale trial in winter.

Gundagai Meat Porocessors chief executive officer Will Barton said the Gundagai Lamb forward contracts for November, December and January were offered due to growing demand for the premium GLQ5+ product across the globe as well as a desire to provide price certainty to leading producers over the spring and summer months.

He said the forward contracts will be offered to select producers only, who have a proven track record in supplying a high proportion of GLQ5+ lambs during these months. GLQ5+ lambs have an intramuscular fat of 5+ percent, along with meeting other carcase weight, lean meat yield and eating quality criteria.

Mr Barton said Gundagai Lamb’s regular value-based marketing grids which use a combination of weight and lean meat yield categories will apply, with sweet spot pricing as follows.

November 2024 – $7.70 per kg + $0.80 per kg GLQ5+ bonus

December 2024 – $7.80 per kg + $0.80 per kg GLQ5+ bonus

January 2025 – $7.90 per kg + $0.80 per kg GLQ5+ bonus

Mr Barton said despite directional trends, the future availability and price volatility of heavy lambs is always difficult to predict.

“Offering forward contracts to producers whose lambs have historically performed well on our GLQ Score grading system at this time of year provides an incentive to hold lambs which they may otherwise chose to sell now at trade weights.

“In this instance ‘select producers’ is defined by the producer achieving a minimum GLQ5+ percentage for the same time last year.”

However, Mr Barton said there will be opportunities for new suppliers to prove themselves with Gundagai.

“Absolutely, while our processing space for the Gundagai Lamb brand is in high demand, we always leave space for new producers to allow us to find the outliers and high performers.”

Mr Barton said Gundagai Lamb believed in building trust via transparency and is therefore “sharing the offer” to allow kill space for 1000 contract lambs in total per week.

“When the 1000 spaces have been filled each week, the contract will be closed for the given week.”

Bendigo young lambs up to $15 dearer

At the Bendigo saleyards on Monday, agents yarded yarded 13,880 lambs, 2611 fewer than last week, with quality improving among new season lines showing more finish and freshness.

The National Livestock Reporting Service said a major southern exporter led the market into dearer territory, and some other buyers weren’t able to fill orders as the good quality young lambs trended above 800c/kg cwt. The NLRS said increasing store demand boosted rates for lighter weight stock under 20kg cwt, with some pens of young lambs to the paddock quoted as up to $15 dearer than a week ago. Agents from Ballarat, Albury, Yarrawonga and the local north-east area were active on suitable light lambs.

The NLRS said most of the lead young lambs from 24-28kg cwt made $200-$240, or 800-820c/kg, after some pens pushed into the high 800c/kg price territory. Medium trades 21-24kg cwt sold from $160-$190, or 760-800c/kg cwt. The NLRS said restockers put a good floor in the market for lighter weight lambs, with bigger framed 18-20kg cwt store lambs making $140-$158, smaller lines going to the paddock at $70-$130. Any well presented old season lambs were dearer at around 760-800c/kg cwt, or $180-$245 for better pens.

Ellis Nuttall and Co agent Rupert Fawcett Jnr said the store buyers paid up to $190 for lambs underpinned by the belief that heavy lambs will be harder to find as the season progresses.

“There are a lot of people shearing lambs already around here.”

He said the new season lamb turn-off in the area is probably a month behind and he expected the ultimate numbers to be “a lot lighter.”

“Quite a few people have gone out of sheep – I can’t believe they are saying there are many more sheep in Australia because that many have gone out of them right across the board (Merinos to crossbreds) … into cropping most of them.”

He said there could a ‘crunch’ in supply later on, especially with the dry copnditions in South Australia and in the Western District.

Nutrien Harcourts Bendigo livestock manager Nick Byrne attributed the higher slaughter lamb prices to the lack of quality lambs available for processors.

“There is a bit of a divide opening up between the good and the also-ran lambs.”

He said the season rather than the number of lambs on farms was contributing to the quality of lambs on offer.

“Seasonally it was a late start and a dry winter which for a lot of places can be good, but not for north of Bendigo where we would normally get a bit of pasture growth through winter, but everyone was hand-feeding through August and some are still hand-feeding.

“So it has been a tough year to get weight in lambs,” he said.

“It’s just a challenge to get lambs to 25kg, let alone 28 or 30kg.”

He said the forward contracts are helping the market.

“We are still the position where if we got a good rain then we could still get out of it OK on most places from a feed perspective, but if that doesn’t happen then it becomes a question of shjearing and feeding, and the cost of feeding.

“Now if you haven’t got something out the other end, people are apprehensive to go down that path,” Mr Byrne said.

He is advising producers that “$8 is $8” and to take the price if they want security, with processors expected to show resistance to paying more.

“You lock in and get some certainty now or you sit on the fence.

“The market for good lambs might well be in excess of that, but if it goes to $8.20-$8.40/kg for a 25 kg lamb, about $205 a head, to get a real gain out of it, the physical has got to be $9/kg or better … and looking at history, the price doesn’t spend much time above $9/kg,” he said.

“If you can get $200-plus for your good lambs at $8/kg it is not to be sneezed at.”

Mr Byrne said he wouldn’t be surprised to see an abundance of light or ‘bag’ lambs being offered this year.

“If the supply of bag lambs becomes even greater again as a percentage of total yardings and there is a bigger margin for processors in that type of lambs, you might find a few more of them doing that … and they might back off on their good heavy lambs into the United States and the EU which might balance out supply and demand.

“It’s going to be very interesting, but I think at the end of the day if you can produce an article you will get paid for it,” he said.

“Are you going to get record prices? I would be very dubious about saying ‘yes’, but I think you will get good prices.”

Lamb contracts helped Forbes store lamb demand

At Forbes yesterday, agents yarded 24,000 lambs, 6100 fewer, with the NLRS reporting quality improving, especially in the 9800 new season lambs. Most of the new season trade lambs sold $2-$5 dearer at $173-$215 and heavy weights reached $248, with most ranging from 780-840c/kg cwt. Old trade weights were firm to slightly cheaper at $166-$198, or 760-770c/kg. Old heavy weights sold from $195-$245, or mostly about 790c/kg, but up to 840c/kg. Merino lambs were $10 stronger with better quality, with trades making $129-$191 and heavy weights selling to $221 and averaging 670c/kg.

Forbes agent Scott Reid from VC Reid and Son said the lamb contracts were helping saleyard demand.

Numbers of quality old lambs were easing, he said, although there was plenty of weight in the new season lambs.

“But the new season lambs aren’t making up the total numbers.

He said Forbes agents have been yarding up to 45,000-50,000 in the last 6-8 weeks and there was only about 30,000.

“The market seems to be holding up extremely.”

Mr Reid said expected the contracts to be filled fairly quickly, but they have helped the store lamb demand.

“Normally when the new season lambs come in here in September to October, the market slides a bit, but it hasn’t.

“I think because they are not expecting as bigger volumes to come out of Victoria this year because it has been so dry and that’s driving the market a bit at the moment,” he said.

Mr Reid said if the weather stays dry producers might take the store lamb price rather run lambs on for fattening, potentially creating supply issues for domestic processors.

“A lot of people are weighing up their options as whether to take the $130 for their lighter lambs or throw them out and get $200 later on.

“At the moment, I can’t see there being enough numbers of really good lambs out of the south to oversupply the market,” he said.

“Everyone is thinking that at the moment.”

HAVE YOUR SAY