Southern Aurora Markets partner Mike Avery.

SMALL volumes of wool were traded forward in another generally positive week for the spot auction market, as all fleece qualities gaining ground.

Medium Merino microns again fared best with prices up 2 percent. Finer wools 16.5 to 19 micron were marginally dearer and crossbred flat.

The forward market painted a different picture. Activity was again mainly focused on the nearby months when looking at traded volumes, with 45 tonnes traded in the May-June maturity window at a slight premium to cash.

Pleasingly small volumes were traded this week in the Spring. The 19.5 micron contract was executed in October and November at 1595 cents, 10 cents over cash. Just as satisfying was to see the 19 micron contract bid every month a full two years out, to June 2025. The bidding is at 1660 cents, which is a 13-cent premium to the current auction close.

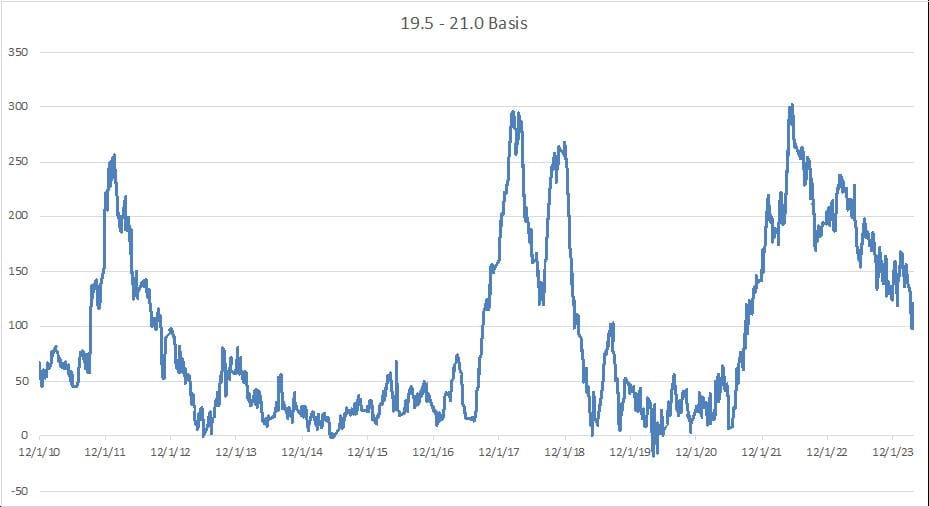

On the broader Merinos of 21 micron, growers are offering into the Spring at 1450 cents. This is about 30 cents below spot cash, but getting only passing interest from buyers. The chart below demonstrates how the price difference between 19.5 and 21 microns has closed to under 100 cents, with 21 micron being in strong demand due to short supply.

The forward market is predicting that this trend will change by the Spring. Whether this occurs due to stronger demand for finer wools or increased supply at the broad end is up for debate. This weeks forward action would suggest the former ie. stronger finewool demand. From a purely technically viewpoint, it is hard to see the slide in the basis arresting soon, but Spring supply might be the driver.

With 49,000 bales on offer next week, we are hopefully of a steady week that might see growers take advantage of the 2024/25 hedging opportunities

This week’s trades

May 19 micron 1640/65 cents 15 tonnes

May 19.5 micron 1565 cents 5 tonnes

May 21 micron 1460 cents 20 tonnes

June 19 micron 1665 cents 5 tonnes

October 19.5 micron 1595 cents 10 tonnes

November 19.5 micron 1595 cents 7 tonnes

Total 62 tonnes

HAVE YOUR SAY