AUSTRALIA’S agricultural forestry and fisheries production value is expected to fall to $86bn in 2023-24, due mainly to lower crop export values, but also decreased livestock returns.

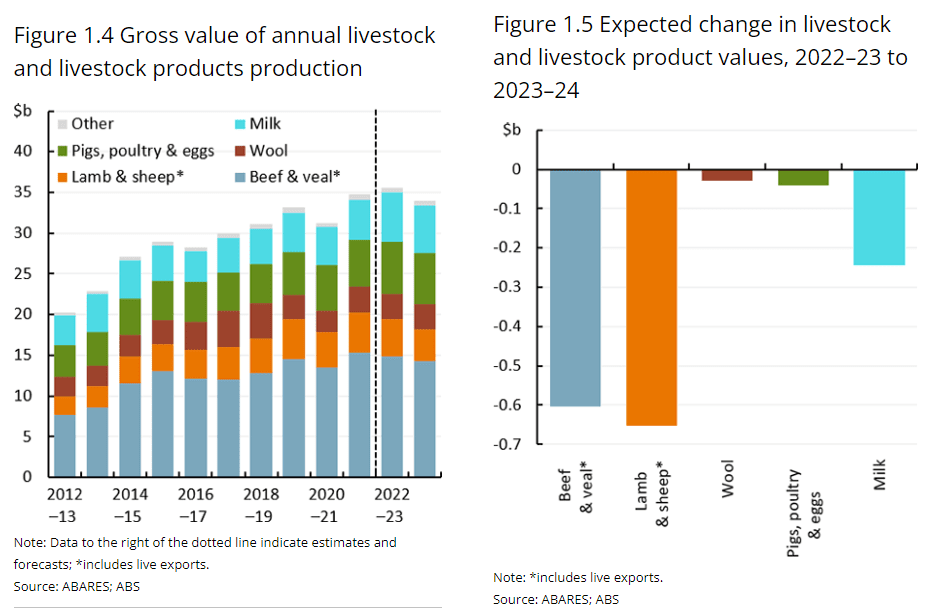

The Australian Bureau of Agricultural and Resource Economics and Sciences latest report said the value of livestock production is expected to fall in 2023-24 as lower prices outweigh higher production volumes.

Livestock production volumes are expected to rise as the drier weather and resulting lower pasture availability increase livestock turn-off rates. Beef and veal production is forecast to rise by 14 percent and sheep meat production by 6pc.

Despite higher production volumes, the value of livestock production is expected to fall by $1.6 billion to $34 billion in 2023-24 because of lower prices. Livestock prices are forecast to fall because of lower domestic restocking demand and higher global beef and sheep meat supply in 2023-24 ABARES said.

ABARES said the forecast decrease in the value of livestock production is mainly driven by beef and veal production values falling by $600 million to $14.3 billion, a fall in sheep meat value by $700 million to $3.9 billion and milk production value ddrop of about $200 million to $5.9 billion.

The value of wool production value is expected to be down slightly to $3.1 billion and pork, poultry and eggs values are forecast to be down slightly to $6.3 billion.

Export values to fall reflecting lower production and prices

ABARES said agricultural export values are forecast to fall by $13 billion from a record level to $65 billion in 2023-24, mainly because of lower crop export values, down $12 billion in 2023-24 to $39 billion. The total value of agriculture, fisheries and forestry exports is forecast to be $70 billion, down from $83 billion in 2022-23. Despite the forecast fall, agricultural export values are still expected to be the third highest on record, ABARES said.

Lower production and export volumes, as well as easing global prices for grains and oilseeds are the main drivers for the drop in crop export values. Livestock export values are also expected to decrease, by $1 billion to $27 billion, mainly reflecting lower export prices for most livestock and livestock products because of higher global supply, ABARES said.

Executive director of ABARES Dr Jared Greenville said today’s release of the ABARES Agricultural Commodities and Crop Reports shows the sector is remaining strong despite challenging conditions.

“For agriculture, after a record $92 billion result in the 2022-23 financial year, the forecast 14pc decrease will see value fall to $80 billion in 2023-24 because of drier domestic conditions and an expected fall in global commodity prices.

“For agriculture, after a record $92 billion result in the 2022-23 financial year, the forecast 14pc decrease will see value fall to $80 billion in 2023-24 because of drier domestic conditions and an expected fall in global commodity prices.

“As we come out of a higher rainfall La Niña period and move into a drier El Niño climate, it is expected that below-average rainfall and warmer temperatures will reduce Australian crop yields and production from the previous year’s record highs,” he said.

“Total crop production value is set to fall 20pc in 2023-24 to $46 billion.

“National winter crop production is expected to be around 45.2 million tonnes, slightly below the 10-year average,” he said.

“Drier conditions are so far having the greatest impact on northern cropping areas, with prospects for the southern cropping regions holding up after better-than-expected winter rainfall.

“It is also expected that summer crop plantings will fall from last year but remain above average, due to lower rainfall forecast for spring and summer being buffered by high levels of water storages.”

Livestock producers expected to send more stock to slaughter

Dr Greenville said drier conditions will also mean livestock producers will need to send more animals to slaughter.

“As supply increases, saleyard prices for cattle and sheep are expected to fall; sheep prices are forecast to fall below their long-term average.

“At the same time, global meat prices are falling,” he said.

“These factors will mean despite higher production volumes, the value of livestock production is expected to fall by $1.6 billion to $34 billion in 2023-24.

“Production and prices outcomes will also weigh on export performance with the value of agricultural exports expected to decrease by 17pc to $65 billion.”

Dr Greenville said farmers are also facing elevated input costs across key inputs such as fertiliser, diesel and labour. High interest rates are also increasing the costs of debt repayments, he said.

“Despite all the challenges, it is important to remember that falls are coming off the back of record years which have helped rebuild financial reserves and our agricultural sector remains resilient and competitive.”

The Agricultural Commodities Report – September can be read here: https://www.agriculture.gov.au/abares/research-topics/agricultural-outlook

The Australian Crop Report – September can be read here: https://www.agriculture.gov.au/abares/research-topics/agricultural-outlook/australian-crop-report

HAVE YOUR SAY