Australia’s livestock-derived exports are expected to fall in 2019-20 as sheep and cattle producers rebuild their numbers.

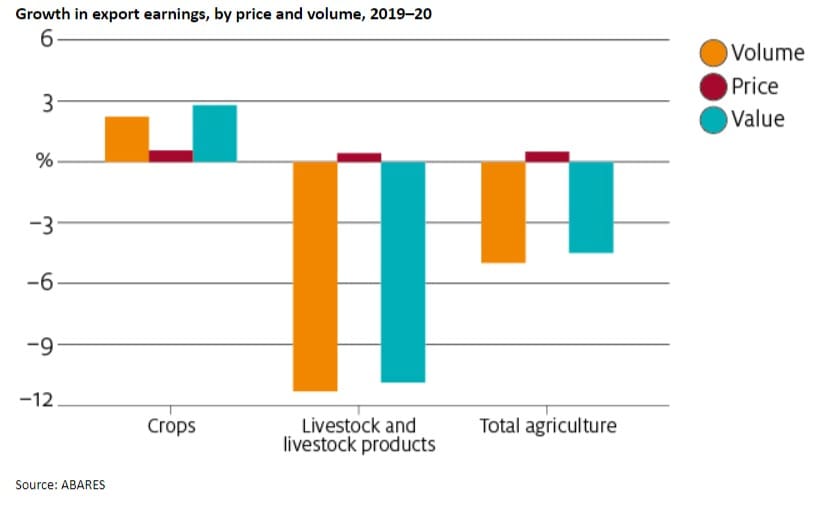

A FORECAST 11 percent fall in the value of livestock-derived exports underpins the latest prediction of a 5pc drop in Australia’s 2019-20 agricultural export earnings to $45 billion.

The latest ABARES Agricultural Commodities report released today is forecasting falling sheep meat production and export volumes, combined with rising prices driven by demand and flock rebuilding.

Wool prices are forecast to fall and production is expected to fall 5.3pc in 2019-20, due to the lower sheep numbers, fewer sheep shorn and reduced wool cuts.

In 2019-20 sheep meat production is forecast to fall due to lower turn-off in the areas of eastern Australia affected by the 2018-19 drought conditions. This is due largely to lower lamb turn-off, as a result of flock rebuilding and a smaller breeding flock. Mutton production is also forecast to fall because sheep slaughter in the eastern states is assumed to return to more normal levels.

ABARES said the national sheep flock is expected to increase as producers respond to the expectation of sustained high sheep meat and wool prices. However, flock rebuilding requires favourable seasonal conditions that will allow lambs to be promoted into the breeding flock.

ABARES has continued its forecast of rising saleyard lamb prices for 2019-20 due to increased competition between processors and restockers, and increasing mutton values due to strong Chinese demand for mutton.

In eastern Australia, restocker demand is expected to increase as flocks rebuilding begins, potentially to the highest price in real terms since 1973-74. Mutton prices will also face upward pressure as a result of reduced sheep numbers at Australian saleyards, ABARES said.

Strong global demand and falling production in major sheep meat exporting countries is also forecast to result in higher prices for exporters, with very strong demand in China, the Middle East and the United States. However, in 2019-20 sheep meat export volumes are expected to decrease due to lower Australian production.

Live sheep exports are forecast by ABARES to fall due to restrictions on exports during the northern summer, with annual export volumes determined by the Australian Government’s ongoing reviews.

Wool prices to fall as more of the clip gets finer

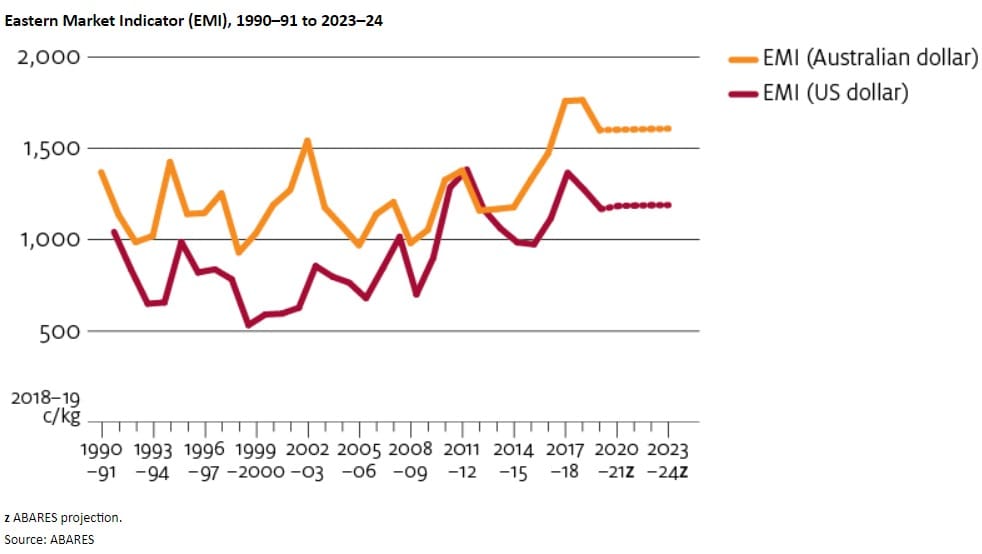

ABARES said the Eastern Market Indicator price benchmark averaged an estimated 1945c/kg in 2018-19 and in 2019-20 is forecast to fall as higher volumes of superfine wool come onto the market and historically high prices cause some processors to substitute towards lower-cost fibres.

ABARES said dry seasonal conditions have pushed the average micron of normally 18.5-22.5 micron wools lower. This has resulted in a higher supply of lower-quality superfine wools (18.5 microns or less) coming onto the market. This combination of higher quantity and lower quality is likely to put downward pressure on premiums for finer grade wool, ABARES said.

ABARES’ chief commodity analyst, Peter Gooday, said that while seasonal conditions have improved compared to this time last year, this is not expected to translate to an increase in the value of exports.

“The decline in export value is driven by a forecast 11pc fall in the value of livestock exports.

“Turnoff and slaughter was high this year and producers will be looking to rebuild herds and flocks as seasonal conditions improve,” he said.

“Export earnings are forecast to decline for beef and veal, wool, lamb, mutton and live feeder cattle but strong demand from China and other export markets is expected to help keep prices high.”

Crop export earnings to increase in 2019-20

Export earnings from crops are forecast to increase by 3pc in 2019–20, weighed down by a forecast $1.7 billion fall in the value of cotton exports following a significant fall in production this year.

“Winter crop prospects have improved this year, and we expect that to flow through to higher grain production and exports.

“We expect the value of wheat exports to be 24pc higher in 2019–20, with export earnings for barley, sugar, canola, chickpeas and wine also forecast to increase,” Mr Gooday said.

“We aren’t expecting grain prices to be as good as last year—world export prices of wheat and coarse grains are forecast to fall due to high global production, and prices of oilseeds are forecast to fall as an outbreak of African Swine Fever reduces feed demand in China.

“Seasonal conditions are more favourable for the start of the 2019–20 winter season compared with last year. However, much depends on conditions during spring—in constructing these forecasts we have assumed average seasonal conditions for spring.”

The full June report is available at agriculture.gov.au/ag-commodities-report

HAVE YOUR SAY