AUSTRALIAN wool prices are forecast to increase in 2015-16, supported by increased processor demand, a lower Australian dollar and falling production, according to ABARES.

AUSTRALIAN wool prices are forecast to increase in 2015-16, supported by increased processor demand, a lower Australian dollar and falling production, according to ABARES.

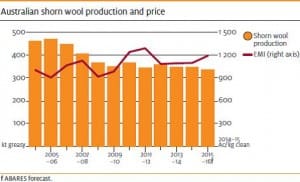

In the latest ABARES Agricultural Commodities June quarter 2015 report, analyst Peter Berry said AWEX’s Eastern Market Indicator (EMI) is estimated to increase by 3 percent to average around 1105c/kg clean in 2014–15.

In 2015–16 the EMI is forecast to increase by a further 11pc to average 1230c/kg clean.

In 2015–16 the EMI is forecast to increase by a further 11pc to average 1230c/kg clean.

In 2015–16 Australian shorn wool production is forecast to fall by 3pc to 340,000 tonnes greasy — the lowest in more than six decades.

Wool price rise reflects inventory demand

Mr Berry said the EMI increased by 17pc between January and May 2015, reflecting stronger export demand for raw wool across most destinations, and aided by a lower A-US dollar exchange rate.

“The increase in export demand partly reflects firmer consumer demand for clothing in the United States and some countries in the European Union, together with a refill of wool inventories in major garment manufacturing centres.

“These factors drove stronger wool buying in the first half of 2015, with most major wool producing countries recording increased export volumes and higher prices.”

China wool demand remains strong

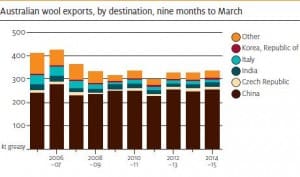

Mr Berry said demand from China has been particularly strong. In the four months to April 2015, the volume of Australian raw wool exports to China lifted 7pc and their value rose 16pc.

Exports also increased by 16pc to the Czech Republic, by 40pc to Malaysia and to the Republic of Korea.

“In 2015–16 demand for wool from major processing countries is expected to remain relatively firm, reflecting improving demand for woollen apparel in some major world markets, such as in the United States and parts of the European Union,” he said.

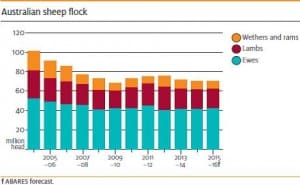

Sheep flock estimated to be 70.5 million by end of 2015-16

Mr Berry said high saleyard prices combined with less than favourable seasonal conditions in some sheep regions such as northern NSW, western Victoria and southern SA have led to continued high lamb and sheep slaughter in 2014–15.

Mr Berry said high saleyard prices combined with less than favourable seasonal conditions in some sheep regions such as northern NSW, western Victoria and southern SA have led to continued high lamb and sheep slaughter in 2014–15.

“Reflecting this, the Australian sheep flock is estimated to fall by 3pc or 2.5 million head by the end of June 2015, to around 70.1 million head.

“In 2015-16 an El Niño event is assumed to result in relatively poor pasture conditions over much of the pastoral zone in the eastern states in the first half of the year,” he said.

“This is expected to hamper graziers’ ability to commence flock rebuilding and result in continued high sheep turn-off and slaughter.

“However, seasonal conditions are assumed to be more favourable in the second half of the year and producers are expected to retain breeding ewes and a slightly higher proportion of lambs in order to commence flock rebuilding.”

As a result, the sheep flock is forecast to increase marginally to around 70.5 million head by the end of 2015-16, he said.

Shorn wool production to plateau then drop

Shorn wool production is estimated to remain relatively unchanged in 2014–15 at around 350,000 tonnes. Dry conditions in some sheep producing regions, particularly northern New South Wales, western Victoria and southern South Australia, have resulted in a decline in flock numbers and a 1pc fall in the number of sheep shorn to 76.9 million head nationally.

Shorn wool production is estimated to remain relatively unchanged in 2014–15 at around 350,000 tonnes. Dry conditions in some sheep producing regions, particularly northern New South Wales, western Victoria and southern South Australia, have resulted in a decline in flock numbers and a 1pc fall in the number of sheep shorn to 76.9 million head nationally.

“However, this was offset by an increase in fleece weights as a result of more favourable conditions in southern New South Wales, parts of Victoria and northern South Australia and very good seasonal conditions in Western Australia,” Mr Berry said.

Wool export values to rise in 2015–16 despite lower volumes

Australian wool exports are estimated to remain relatively flat at 427,000 tonnes greasy in 2014–15, reflecting static shorn wool production.

“Further reductions in the national flock and the number of sheep shorn are expected to drive down the volume of Australian wool exports by 2pc in 2015-16 to 418,000 tonnes greasy.

“The value of Australian wool exports is forecast to increase by 5pc in 2015–16 to around $3.1 billion, with higher export prices more than offsetting the reduction in export volume.”

Low pipeline stocks driving demand

Mr Berry said in the nine months to March 2015, Australian exports of wool to China increased by 3pc year-on-year. However, Chinese wool demand was stronger in the March quarter of 2015 and the volume of wool exported to China was 6pc higher than in the same period a year earlier.

“The increase in processor demand for wool may be a stronger indicator of low pipeline stocks of raw wool than of increased demand for woollen textiles and clothing.

“China’s Customs statistics for July 2014 to April 2015 show a 9pc decline year-on-year in the value of woollen woven fabric exports in US dollar terms.”

Mr Berry said the value of knitted garments of all fibres, including wool, fell by 6pc year-on-year for the same period, while woven (non-knitted) garment value rose by 12pc (all fibres, including wool).

“Given the reduced export values for woollen fabrics and knitted garments, it is likely that export values for woven garments made from wool were also lower.”

China-US wool clothing trade is important

The United States is one of the largest wool consuming countries at retail and importers of wool clothing. Mr Berry said according to the US Office of Textiles and Apparel, in 2014 the US imported 223 million square metre equivalents of wool apparel, a 3pc increase from 2013.

The United States is one of the largest wool consuming countries at retail and importers of wool clothing. Mr Berry said according to the US Office of Textiles and Apparel, in 2014 the US imported 223 million square metre equivalents of wool apparel, a 3pc increase from 2013.

“However, in 2015 imports have slowed, rising by only 0.1pc year-on-year in the four months to April 2015.

“China was the source of more than half of US imports of wool apparel in 2014.”

Mr Berry said US imports of wool apparel from China increased by 1pc in 2014, but fell by 4pc year-on-year from January to April 2015, losing ground to increased imports of apparel from ASEAN and India.

“In contrast, the European Union increased its exports of woollen apparel to the United States by 5pc in the four months to April 2015.

“At a much higher unit value, demand for this higher-end luxury clothing was aided by the stronger US dollar and strengthening economy.”

In 2014, the European Union supplied 7 per cent of US wool clothing imports by volume and 22pc by value, Mr Berry said.

Chinese apparel demand is also strong

China is also a major consumer of woollen apparel and textiles, consuming around half of its finished production. According to China’s National Bureau of Statistics, China’s clothing retail sales (all fibres, not only wool) increased by 10pc in 2014.

Clothing sales were stronger in the March quarter 2015, up by 11pc year-on-year and by 13pc year-on-year for the month of March alone. Sales of woollen cloth in China were strong in the March quarter 2015, up by 13pc year-on-year and following a 5pc rise in the 2014 calendar year, Mr Berry said.

Source: ABARES.

HAVE YOUR SAY