WoolProducers Australia CEO Jo Hall is concerned the BPL might have the effect of reducing the industry’s research, development and marketing levy.

AUSTRALIAN wool growers might vote for a reduced levy for research, development and marketing this year if the proposed biosecurity protection levy was introduced, a Senate committee inquiry was told yesterday.

WoolProducers Australia chief executive officer Jo Hall told the Rural and Regional Affairs and Transport Legislation committee that the industry’s triennial WoolPoll ballot this year could be compromised by the Federal Government’s proposed BPL.

Ms Hall told the committee that WPA would like to see the BPL tax be taken off the table altogether, but a delay of at least six months would be welcomed.

“In the wool industry we are relatively unique in the fact that every three years wool growers undertake a poll (WoolPoll) to determine the amount of levy for research, development and marketing.

She said the proposed 1 July introduction date for the new biosecurity tax could not come at a worse time for wool growers “in light of the fact that a mere few months later every single wool levy payer in the country will be receiving information packs on how to vote, or the decision they need to make on how much levy should go towards research, development and marketing.”

“We strongly believe that with the imposition of this new tax the lines between this levy and the (WoolPoll) RD&M levy will become blurred and therefore our research and development levy could be compromised by the introduction of this new tax.

“That is not a fair position for Australian wool growers to be placed in, let alone our RDC (Australian Wool Innovation),” she said.

Ms Hall said the wool levy is currently set at 1.5 percent, but eligible wool levy payers this year will have a range of WoolPoll levy options to choose from this year, including a compulsory zero option, to set a new levy for the next three years.

Ms Hall said WPA did not believe that post 1 July and with growers’ wool sale results, that they will make the distinction between the RD&M levy and the new BPL.

“All they will see is more money off their bottom line, and that really jeopardises the upcoming poll.”

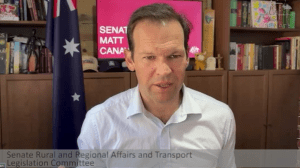

RRAT Legislation Committee deputy chair Senator Matt Canavan was told the biosecurity levy might effect a reduction in the wool levy.

When asked by committee deputy chair Senator Matt Canavan if the situation would cause more wool growers to potentially choose the zero WoolPoll levy option, and reduce the R&D levy, she said:

“Definitely a reduction.

“It’s pretty tough in wool grower land at the moment,” Ms Hall said.

“Prices and inputs, like in every industry, are going higher, but our current (wool) market indicators are not doing well.

“We’re hearing a lot of anecdotal stories of people considering to leave the sheep and wool industry in Australia,” she said.

I was at an international wool textile organisation conference last week in Adelaide with the global wool supply chain. It’s tough in this industry at the moment, and the last thing producers should cop is another tax.

NSW Farmers president Xavier Martin endorsed Ms Hall’s concerns.

“We’re hearing it from members.

“I’ve been in front of dozens of branch meetings in the last few weeks, and they’re saying quite clearly to me, not just around WoolPoll coming up and the costs around that, but they’ve got a federal government mandate around electronic identification for sheep and goats for every animal that they run,” he said.

“That’s a huge impost out of left field. But then they have got a government that, confusingly to them, wants to tax them for consolidated revenue around biosecurity, when they already levy themselves.

“So it’s quite the nonsense, and they are really frustrated about it.”

BPL policy has been rushed — Sheep Producers Australia

Sheep Producers Australia CEO Bonnie Skinner addresses the biosecurity levy inquiry.

Sheep Producers of Australia chief executive officer Bonnie Skinner agreed with the evidence of Cattle Australia CEO Dr Chris Parker that it is still unclear how the BPL will be collected.

“We are yet to determine or understand or find out anything in terms of how this will be applied on farms.

“When this levy was proposed initially for the sheep industry, we operated with a transactional levy system,” Ms Skinner said.

“This levy is now going to be collected at the point of slaughter, but it’s simply not understood from our industry how that will feed back to the farm gate.

“But we certainly understand there’s going to be an imposition of significant cost there for producers.”

Ms Skinner said the development of the BPL policy has been rushed and is unrealistic.

“Industry is still trying to comprehend, let alone prepare for, the impost of the biosecurity protection levy.

“And that’s really at odds with what we have with our agricultural levy system, which is well established,” she said.

“It’s underpinned by really solid principles around equity, efficiency and transparency.

“Also, with the agricultural levies, we have a clear demonstration from our industry around the willingness of producers to co-invest with governments in priorities that drive things like growth and competitiveness,” Ms Skinner said.

“We’re yet to see any of that good faith come from the government on, particularly, that transparency piece.”

The easiest way to over-burden an industry to oblivion is to over-tax it. If government wants to destroy the cash cow it can do it by over-taxing. It might be better to tax mischievous society of drugs and mischievous living. Try sport. Sport is entertainment, not wealth-creating. Sport transfers cash from one area to another. Sport is where as a society we spend our excess cash. Sport does not build wealth for services such as hospitals, schools and infrastructure.

The Federal Government says it is trying to prevent diseases being imported. So importers should pay the levy, not the farmers who will be affected by government’s failure to detect problems at the border. Just more wooly thinking from government.