SUPERMARKET giant Coles has released a July forward contract price of 830c/kg contract price for 18-26kg lambs, but analysts are already asking will it be enough to attract supplies.

SUPERMARKET giant Coles has released a July forward contract price of 830c/kg contract price for 18-26kg lambs, but analysts are already asking will it be enough to attract supplies.

Processors are increasingly becoming concerned about supply leading into winter after rain in parts of New South Wales, reports of low scanning rates and an expected late and greatly reduced turn-off of new season’s lambs.

The contract price for delivery at Gundagai in New South Wales and at Colac in Victoria from 1-29 July is a 30 cent lift on the supermarket’s June contract price, and about 50 cents above the previous June contracts of other companies.

Lamb prices are expected to be extreme in August, before any new season lambs come onto the market. Indications of what is coming were also seen in the saleyard lamb sales this week, with prices starting to edge over 800c/kg for trade lambs and higher for some restocker lines.

Riverina Livestock Agents auctioneer James Tierney said it is hard to know how dear the lamb market will get in coming months.

“It will get very dear – we might see lambs make $9 again, but I don’t know when.

“There will definitely not be a lot of lambs around for this winter.”

He expected processors might be forced into earlier maintenance or shift closures due to a lack of numbers.

“But whether that will be enough to stop it (the price rise), and I doubt it will be.”

He said there would not be many early lambs coming out of New South Wales this year.

“This little bit of rain that it happening now will assist that, but the scanning results are terrible anyway.

“For a start the numbers are going to be a lot less, added to the ewes that have been sold to get their heads cut off,” he said.

Mr Tierney said mutton sheep will also be extremely scarce.

Landmark Harcourts Bendigo livestock manager Richard Leitch believed 830c/kg will not be enough money to attract lambs this winter, but future lamb numbers and saleyard prices were an unknown.

“I don’t know where it will go, but I can’t see 830c/kg being anywhere near it, but I’ve been wrong before.”

Factors pointing to a very tight winter supply of lambs include producers being forced to sell earlier due to the difficult season and spiralling feed costs.

“Ninety percent of your lambs are gone – traditionally I would have blokes that shear lambs and hold them over, but I haven’t got a place that has kept lambs this year.”

He said some traders that normally keep lambs on feed have been operating, but to the extent of previous years.

“Sheep will be the other big issue for them.”

He also expected to see an earlier wind-down by processors in shift hours or for maintenance due to lower available lamb and mutton numbers, and the national flock rebuild expected to take years.

“What I am being told is they don’t want to because they have got such demand for it.

“They would love to keep operating, but they need numbers to kill,” he said.

“If we get any sort of a break, you won’t be able to buy a ewe lamb, because all through the Riverina are that low in numbers.

“Traditionally they have had to sell for a cashflow, but the wool job has been that good, they have cash in reserve, so any ewe that hits the ground with any sort of break, they will be keeping them.”

Landmark’s national livestock director Mark Barton said the industry was getting into the “back-end” of available supplies.

“A lot of those late lambs that people would normally hold onto, I think we have already seen them on the market over the last 6-8 weeks.”

He said 800c/kg had already been offered for June.

“And if you look at July and August, you would wonder how many early new season lambs we are likely to see on the back of a tight season, the ewe numbers that have been slaughtered and poor scanning rates?

“We are just not going to have the lambs,” he said.

“To pitch yourself north of 800c/kg for June and July is quite realistic isn’t it?”

Signs point to an impending lamb shortage

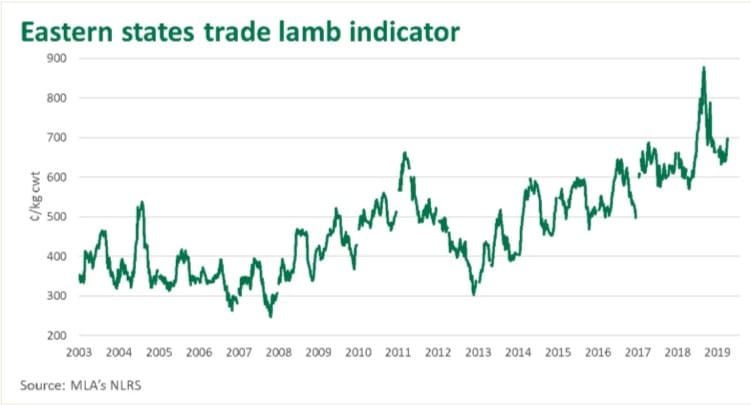

Meat & Livestock Australia last week reported that the national benchmark trade lamb indicator broke through the 700c/kg mark this month for the first time this year and almost three months earlier than last year. With the exception of weekly slaughter data, all major signs point towards an impending lamb shortage during winter, MLA said.

The Eastern States Trade Lamb Indicator averaged 708c/kg carcase weight (cwt) on April 10, up 22 percent year-on-year. At that level, the indicator remains 176 cents below the all-time high reached in August last year. However, if the anticipated supply shortage comes to fruition, price volatility may return, MLA said. The ESTLI peaked at 725c/kg on Tuesday, before falling to 721c/kg on Wednesday.

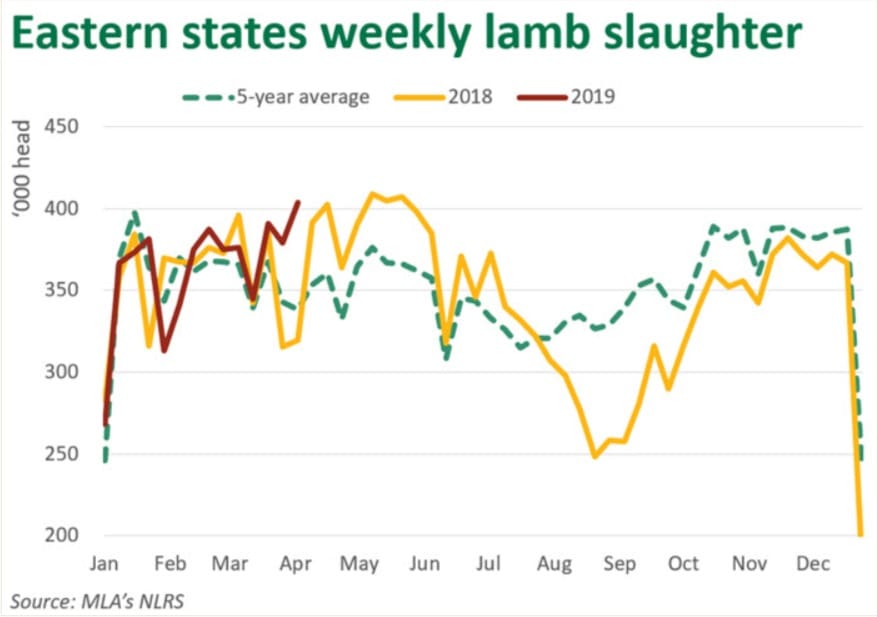

MLA said considering the recent high sheep slaughter, poor seasonal conditions and reported low marking rates, the supply of lambs has remained surprisingly reliable throughout 2019. For the year-to-date (through 5 April), eastern states lamb slaughter averaged 360,000 head per week, up 2pc on 2018.

At Ballarat on Tuesday, the National Livestock Reporting Service said well-finished heavy lambs suiting the export and domestic market jumped up to $12 selling to $188-$192 and the extra heavy export lambs between 26kg and 30kg lifted $5 to $194-$192, averaging 749c/kg cwt. The over 30kg lambs eased up to $12 due to lack of quality, selling between $198-$206.

HAVE YOUR SAY