Chris Howie offers his perspective on market trends and opportunities in coming weeks and months, drawing from his own observations and from a wide contact network of producers, agents, processors, industry associates and leaders developed during his extensive career as a livestock agent. Chris is Stockco’s Business Development Manager.

Chris Howie offers his perspective on market trends and opportunities in coming weeks and months, drawing from his own observations and from a wide contact network of producers, agents, processors, industry associates and leaders developed during his extensive career as a livestock agent. Chris is Stockco’s Business Development Manager.

What was the impact of the January COVID outbreak?

We are still seeing the remnants of the COVID impact from January washing through supply. Speaking to several agents at the South Australian Livestock Exchange at Dublin it was evident many producers and agents have had to hold contracted lamb deliveries for an additional 3-4 weeks which has caused some frustration. As a counterbalance to this, I also spoke to several feedlots and a couple of processors. The January issue has compounded as it flowed along the supply chain with every part having its own frustrations and trials.

One feedlot spoke about the backlog of cattle that were delayed. Cattle held on feed impacted the cattle coming in from the backgrounding paddocks which impacted the contracted cattle, this in turn disrupted the ability to buy at the early weaner sales. Impact on cash flow with additional feed cost as all the payments are going out without sales coming in really bite in this scenario. Do the rough sums on a feedlot buying 1000 a month whose purchase value is $2400 – $2700 per head and it will quickly show the size of the cashflow disruption.

Processors have had to manage a shortage of staff in an already depleted meat work force without visa employees. One processor said they have 200 vacancies that have the HR team at wits end as they try to balance the staffing requirements. This was compounded by logistics including transport, availability of containers and waterfront blockages. Internationally the Australian read meat industry still have customers lined up waiting for supply because of the marketing and quality reputation built up over many years.

Food for thought – It has surprised me since the advent of agronomy advice in the early 2000s how many farmers refuse to run sheep on summer rain germination. As example from one agent at Dublin: A neighbour on one side of his place ran trading sheep and has only had to apply the final spray to close the paddock down after the last rain. Across the road refuses to run sheep and has sprayed 3 times. Even if the sheep trade only breaks even, my simple math tells me with the price of spray and fuel the first farmer is in front. If you don’t like sheep let some one that does do the job for you. And before I hear the words “compaction”, are you suggesting your 350hp big red, blue or green tractor cannot break up the foot tread of a 55kg sheep?

What does the next 6 months look like and how fragile is the current cattle price? My thoughts are the only thing holding the cattle price is continued rain. How long this extended season runs for I don’t know and the optimist in me hopes this is the Australia of the future. Do we blame global warming for that or is just nature doing her stuff – doesn’t matter really because it is good for many in the livestock industry?

The realist in me says at some point feed will start to shorten and cattle will need to be sold versus being marketed in a timely fashion. Why raise this now you may ask? I noticed last week the EYCI which seems to be the bible for some dropped 17 cents in one day on a blip in demand. Yet when it rises it only seems to be in 1 – 4 cent increments. This is a great example of how quickly the livestock prices can drop – hours not weeks.

It is highly unlikely processors will have the capacity through staff shortage or supply to ramp up shifts if we do see a rise in sale numbers and simple economics state that additional supply of slaughter cattle will see prices ease. If you have an awareness of this dynamic in your cattle enterprise, I expect, you will have risk settings in place to manage your sale program.

However, if we look at the recent lamb correction some fell into that “she’ll be right, prices are here to stay” category and got a rude shock.

My advice is buying short and sell long whilst these cattle prices are around. Fast trades with extra weight and only 1 winter or 3 in one cow and calf units are great options. With your processor sale cattle start looking at the winter supply window to utilise excess feed in some areas.

Training A great week spent with 18 young agents from 12 different agencies at Wodonga TAFE doing their Agency and Supply train Certificate 4. Geoff Rice AWN Langlands Hanlon and a range of guest speakers were involved in the week.

Steve Chapman, JBS Southern Livestock Manager spoke to the group after an evening meal and the engagement and questions were exceptional. Steve covered resilience and relationships as well as other topics. What did come to mind was any agent who has only been in the industry for 5 years has yet to see a difficult time with livestock pricing.

How to handle a difficult conversation with a client, processor or feedlot is something that needs to be worked on for the future not avoided – reputation and relationship are paramount. Gather information in advance not looking for an excuse after the event is some good advice for many.

COVID stretched these 2 groups out longer than normal but the engagement and change over the past 12 months really highlights how young people move from new starters to walking and talking like agents and industry leaders of the future. Another group of 15 start at the end of March.

Sheep and Lambs

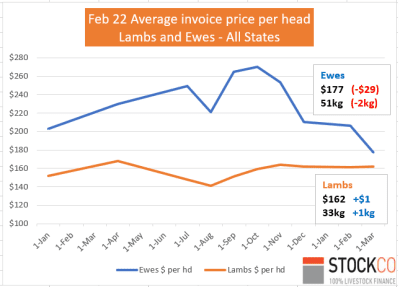

Price reset on lambs and sheep normally appears at the end of January with a return from school holidays and an “oh shit” moment because the stubbles are done or paddocks have bared out. This activates a run of numbers and supply and demand takes control – prices fall. This years rain delayed the normal shift for 3 – 4 weeks luring many into thinking it would not happen.

What was the catalyst for the surge of numbers? Additional rain saw another germination event which activated the “burn diesel” response syndrome causing paddocks to be sprayed and sheep and lambs to be quit. This created a multiplied concertina effect on top of the already delayed contract deliveries. Boom – a correction of $20 – $40 and a few tears around the place. The following week we saw a $10 – $15 recovery and some solid April contracts appearing for $8 / kg. I think March will be finely balanced with regional dips of $10 – $15 occurring with only a small changes in numbers presented at various saleyards.

For those looking to buy lambs for the winter supply hole this correction provided a short term window of opportunity to buy heavier lambs. However the lighter store lamb demand hardly faltered when looking at the average invoice prices that StockCo process.

StockCo invoices for lambs continued to flat track irrespective of the processor price correction mid February. Many lamb traders still have residual contract lambs in the paddock awaiting delivery and have not re entered the market. Grain pricing and availability of summer feed has also seen lamb grain feeders struggle on margin. With many the cost of feed is where the positive trading margin has been absorbed if the lambs were sold on the spot market.

Ewe values fell as the mutton pricing drop saw opportunities in the market. Many SIL ewes have already been purchased and are due to stat lambing over the next month. Demand for unjoined ewes has backed off as spring lambers will wait a bit longer. Ewes with a start in the jacket at this time of the year are an excellent short trade option if you can fatten and shear.

Cattle cross over

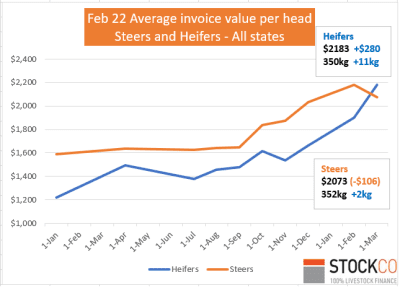

StockCo cattle invoices: For many years we have spoken of the value of the female, yet it has never really appeared over an extended time. I think this is the first time I have seen the girls run over the boys with the comparison number being quite significant for the month and nearly the same in number of head purchased per sex.

I will be interested to see how the next run of weaner sales go starting this week in Tasmania and the mountains. As I mentioned earlier many are starting to look at the flexibility of a heifer if the market eases allowing a 2-way bet. Steers are still in demand, but I think a bit more thought is going into the buying than the emotion seen at the earlier sales. Light weights are still making exceptional money across all breeds.

Bull sales in the south – congratulations to all vendors. The line up and results were outstanding. The studs that are genuinely engaged in the productivity outcomes of their clients have really rept the rewards this year. Confidence, trust and performance. It was always good to play in a footy side that had these attributes. The stud game is the same.

Opportunities for jobs in agriculture. If you know anyone that is looking for a start the world is their oyster. Processors, feedlots, agencies, wool industry, farm hand and overseers. I have never seen so many vacancies for quality people to come on board. Many of these employers are keen to put a career path in front of a new starter who is driven to succeed.

For the new starters I suggest leave the “entitlement” expectation in your car before your interview and enjoy the ride of learning as your career develops.

At the Adelaide Livestock exchange the other day I caught up with many of the buyers and agents who helped me as a young auctioneer in the Gepps Cross days. Jack Thomas from Thomas Foods International was one of the next generation buyers I met. His grandfather Chris in the T&R days did the Gepps Cross sheep buy and helped many of us younger agents at the same time. Jacks father Darren, now TFI MD also learnt as a buyer with time spent in the car doing paddock jobs when I was at Eudunda. This family linkage is replicated across so many agencies, processors and feedlots and shows the value in learning from the ground up with any career. Do the time and reap the rewards.

Opportunities

Lambs for winter supply –

- remember the price spike is getting a bit later every year.

- Be careful of age when buying store lambs from now on.

Mutton – great time of the year to buy older ewes to improve or join

Heavy store cattle – pick through the fat sales.

Start talking to agents and processors about winter supply windows

If stock are fat sell and take the money

Stockpile your feed for winter to concentrate on opportunity buying.

HAVE YOUR SAY