AWH CEO Michael Jones outlines his China Plan

AUSTRALIA’S biggest wool handler AWH is hoping efficiency initiatives and data-driven innovation can “pull-through” more bales into its farm to port network, leading to an expansion into China.

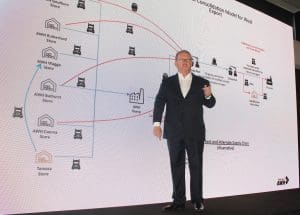

At its inaugural Wool Export Innovation Summit – Woolex — in Geelong last Friday, AWH’s chief executive officer Michael Jones outlined the company’s ‘China Plan’, which is underpinned by a revolutionary suite of digital data applications and “game-changer” farm-to-market wool-handling innovations.

AWH currently services over 55 percent of the nation’s traded wool, handling about 1 million bales annually, and wants to handle more wool, although Mr Jones would not disclose AWH’s projections for business growth from its initiatives.

“We’re not a buyer, we’re not a broker, we want to handle more wool and we want to use our growing strength and capability in the end-to-end logistic solutions to facilitate that and be better at it,” Mr Jones said.

Click here to get the latest Sheep Central story links sent to your email inbox.

AWH is hoping to increase its bale market share “pull-through” with buyers and brokers not currently AWH clients, by consolidating store-to-port wool transport – “AWH’s Nirvana” — with multi-buyer loads, low compression packing, shipping and storing other brokers’ wool, maximising backhaul, use of road and rail transport, and container triangulation through a hub-and-a-spoke approach.

“What we want to create is a compelling commercial solution that basically makes good sense for other people to use us as a preference in their logistic solutions with wool,” Mr Jones said.

AWH wants to ‘suck’ wool into its stores

The company want to provide enough efficiencies in its pipeline that buyers will want to buy wool from brokers who handle wool through AWH “and thereby creating that pull-through effect which we are after,” he said. He believed this will give AWH its greatest traction in its China plan.

“The concept behind that is to make the post-sale exit of wool from the store to China cheaper and simpler for buyers,” he said.

AWH also wants to stop “leakage” of wool that comes into an AWH store, but is sent somewhere else for packing.

“We want to turn that around so that we become so efficient and price competitive that we actually suck wool into our stores from other people.”

Mr Jones said AWH was working on an ‘a la carte’ block pricing model to make the company’s wool-handling solutions a compelling commercial imperative. Every element of the wool supply chain has been broken down by price and activity, including post-sale data analysis, to come up with a better block pricing position.

“The offer is very simple, if we can do this cheaper than you, why would you duplicate it, let us do it for you and because we obviously going to have more volume going in some cases we could take on some of their staff as we grow to make it a more centralised function.

“The economies of scale and the efficiency is what we are going to try to offer.”

WoolTrack RFID system is biggest game-changer

AWH’s wool-handling initiatives would be facilitated through a range of digital web-based apps for classers, brokers, transport operators and buyers underpinned by an RFID-tag WoolTrack system able to monitor the movement of every bale from farm to mill.

“The synergies and seamless supply line flow the RFID (system) offers us and ability for us to take the provenance all the way and utilise that RFID individual bale identification all the way into China is why the light bulb has kept coming on and why we started embarking upon this.

“It’s a crazy little technology, but what it is going to do for this industry… I believe it is the biggest game-changer that we’ve seen in a long time; the opportunities become almost endless,” he said.

“Because of those 121 measurable points in the wool process that I keep talking about, that’s why that horizontal barber’s pole of slicing and dicing, and being able to provide a block pricing solution and a compelling commercial imperative is why this is going to work.”

Hardstand to aid triangulation

Mr Jones said AWH has tens of thousands of square metres of under-utilised hardstand (open areas for storage) suitable for container storage which can be designated as empty container parks.

“We can get other companies dehiring containers and bringing them to our facility at their charge so that we end up with more containers.”

An AWH business improvement team is working on how through a hub and spoke model can it get consolidate wool out of other regional stores into its for packing or dumping in its stores for transport to ports in multi-buyer loads via road or rail. AWH hoped to use a hub-and-spoke model to justify non-AWH broker clients in Australia moving wool from their stores into AWH stores, Mr Jones said.

“The road component is a lot shorter, the handling time and differences are a lot shorter and then we do large line haul in bulk from central hub-and-spoke processes.”

China land partner needed

AWH has done a detailed analysis of the shipment of wool from Australian ports to China, including block consolidation in global shipping and mill locations. Mr Jones said if AWH goes into China, ground transport systems would have to be looked at, but he believed a solution to shed warehouse space costs could be found with the right partnerships.

AWH already owns a specialist company for customs clearance and freight forwarding it hoped to use as a catalyst for growth. AWH would need a Chinese partner or office located in the major receiving ports, but he believed there were significant benefits in the base model without the land component in China.

Single buyer loads into China reduce the efficiency opportunity offered by doing multi buyer loads, he said.

Key strategies to create efficiencies for the China plan included the WoolTrack RFID tags, handling wool less and proprietary systems such as lower compression packing, putting up to 144 bales in a 40 foot container at less cost than conventional dumping.

“Then getting the economies of scale into transport by the use of the Trucker app to manage the complexity and the price component of the transport legs whether they be transport legs from store to pack house, pack house to port or from store to store, as it currently happens in a lot of situations, we want to manage that.

Mr Jones said the China plan will include efficiently moving and importing empty containers back to “the point of pack”, and getting a better price from global logistics company DP World, AWH’s part owner.

“So that we get that loop operating more times in a day.”

He said AWH has been in negotiations on post-sale shipping charges from store to China and “we’re pretty sure we are going to get a pretty good rate.”

Mr Jones said the RFID tag tracking system made it a simple exercise to put together wool bales for multiple buyers to make full truck/shipping loads to port which can be unpacked in China into mill or buyer loads. The WoolTrack system also gave AWH a huge competitive advantage for efficiencies in its export freight forwarding documentation.

“Currently the buyers do it as a CIF process where they are charged for shipping, insurance and freight delivery to the port in China and the transaction effects at some stage before it arrives in China and they are paid by redemption of a Letter of Credit.”

“In a lot of cases their terms vary on each buyer and mill basis, that doesn’t necessarily change; all it is that they don’t have to physically be the ones organising that; we do it for them and let them know where it happens and then they can still present those LCs and it is actually done on a verifiable time code transfer,” he said.

“We’re looking to simplify the pricing and the processes so that we can provide in that horizontal barber’s pole and our block pricing model a better solution.”

Low compression packing a game-changer

Mr Jones said the wool trade is currently dumping 112-120 bales into a 20 foot container, or about 112 loose farm packs into a 40 foot container, or about 144 bales as a mixed dump into a 40 foot container. Mixed dumping didn’t appear to be very cost efficient, but low compression dumping would give AWH a competitive advantage in creating an end-to-end solution, he said.

AWH owned the rights to a low compression system originally developed to compress cotton bales, which it is looking at rolling out through its network. It reduced the time needed to pack a 40 foot container.

“It is only just slightly more expensive than doing farm packing and we get 144 versus 112 bales into a (40’) container,” Mr Jones said.

“It’s a big game-changer for us from a handling perspective.”

Container value proposition suits triangulation strategy

Mr Jones said the significant disparity between the value proposition for 20 foot and 40 foot containers used for imported goods had created an excess of 40 foot containers in Australia.

“So they (40’ containers) are relatively cheap compared to 20’ containers, except out of WA.”

Whereas years ago AWH would have dumped 93-95pc of its wool, this was now below 50pc, and the trend was continuing, he said.

Mr Jones said triangulation to minimise movement of containers is one of the challenges facing AWH, especially across regional areas.

“Triangulation of containers is where we believe the greatest efficiencies in cost reductions will be gained.

“It is relatively simple in metropolitan areas, but is infinitely more complex in regional areas, but AWH is scoping out how to do it across its full network.”

The company is also looking at its store locations, inter-modal sites and rail transport of full containers to ports. Mr Jones said he hoped to co-operatively generate benefits for brokers moving wool from their stores to ports through its in-house freight forwarding business and transport solutions.

“We believe there is a huge opportunity for this, this is something that I’m very passionate about.

“Quite apart from improving our internal process, I believe that having a cohesive end-to-end logistics solution for wool to China for this industry is something that we should work more on.

“It is something that we want to offer the marketplace,” Mr Jones said.

AWH is owned by one of Australia’s largest wool brokers Landmark and DP World Australia, Australia’s largest container terminal operator, which has terminals in Brisbane, Sydney, Fremantle and the Port of Melbourne. DP World Australia is a subsidiary of the UAE-owned DP World. Landmark is owned by the Canadian-based agricultural services and product company Agrium Inc.

Click here to see the location of AWH and other brokers stores.

Click here to see AWH’s conceptual consolidation store-to-China plan

HAVE YOUR SAY