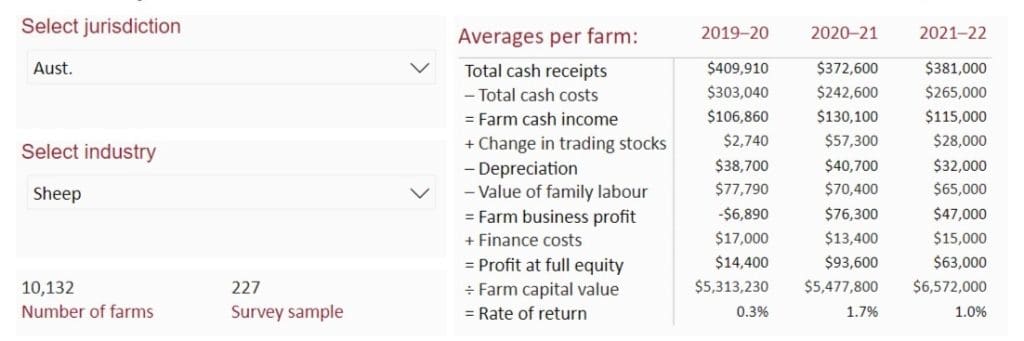

AVERAGE cash income for sheep specialist farms is estimated to have decreased slightly in 2021–22 to $115,000 per farm as high meat prices offset fewer lambs sold for slaughter, according to the latest ABARES analysis.

However, ABARES said the sheep farm result remained 3 percent above the average in real terms for the previous 10 years.

The average rate of return (excluding capital appreciation) for sheep specialist farms is estimated to have been 1pc in 2021–22, in line with the long-term average.

Average sheep farm income down, yet above 2019-20

Average beef farm income rises

The sheep results contrasted with an average farm cash income for specialist beef farms of about $255,000 in 2021–22, around 90pc above the average in real terms for the previous 10 years.

However, ABARES said despite higher incomes overall, a number of cattle farms in south-east Queensland, the Alice Springs region of the Northern Territory and the Pilbara of Western Australia recorded incomes below the longer-term average. This appears to have mainly been a result of herd rebuilding and reduced sales of cattle.

The average rate of return (excluding capital appreciation) for beef specialist farms is estimated to have been 2.5pc in 2021–22, higher than the 10-year average of 0.6pc per farm, ABARES said.

ABARES said an estimated 38pc of Australian farm businesses are classified as broadacre livestock farms (34,000 farms), of which 19,500 were beef specialists, 10,000 were sheep specialists, and around 4500 produced a mix of beef cattle and sheep (see Methodology).

High commodity prices in 2021–22, particularly for beef cattle, and good seasonal conditions, were the major drivers of continued strong farm financial performance of livestock farms across Australia, ABARES said.

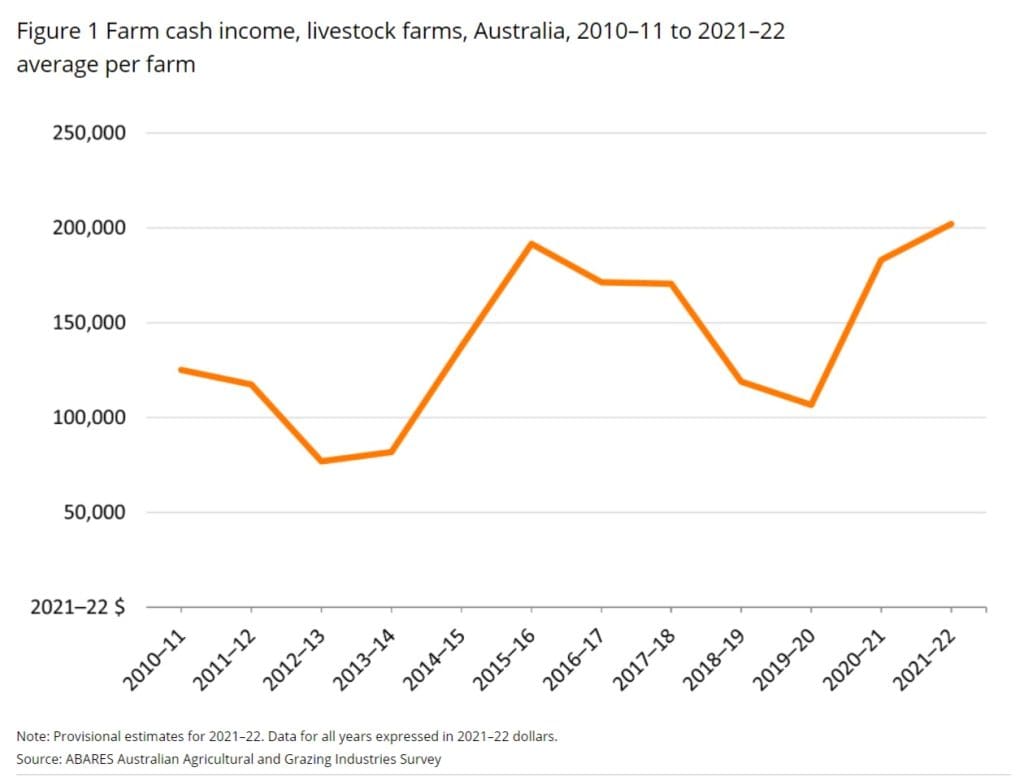

At the national level, average farm cash income for livestock farms is estimated to have increased by 10pc in 2021–22 to $202,000 per farm.

High prices for beef cattle and sheep are projected to have offset fewer sales of finished livestock, with many farmers continuing to rebuild herds and flocks since the drought (Figure 1).

ABARES said the timing of purchases of inputs and sales of livestock during the year is likely to have influenced the results observed on individual farms given the fluctuations occurring in the market.

The average farm cash income for livestock farms in 2021–22 is estimated to have been around 49pc above the long-term average of $136,000 per farm in real terms for the 10 years to 2020–21.

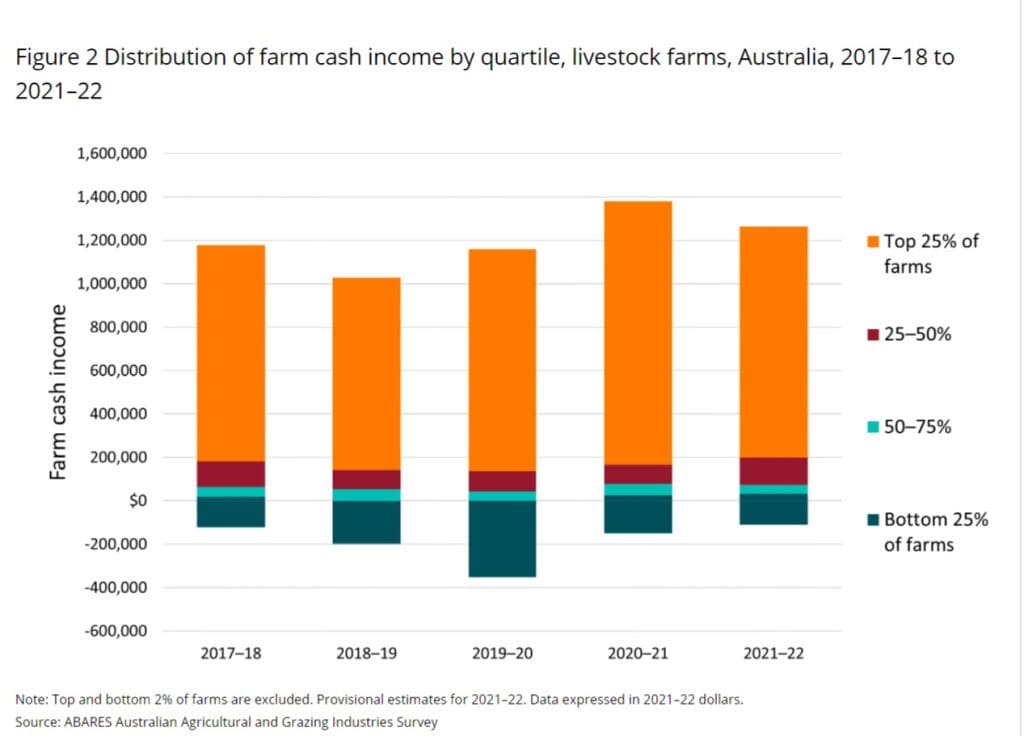

The percentage of livestock farms with negative net income in 2021–22 is estimated to have been around 12pc.

The average rate of return (excluding capital appreciation) for livestock farms is estimated to have been 2pc per farm in 2021–22, above the 10-year average of 0.7pc.

In 2021–22, average farm cash incomes declined for livestock farms in Tasmania (–16pc) and Victoria (–7pc), but increased in the Northern Territory (99pc), New South Wales (28%), Western Australia (19pc), South Australia (11pc) and Queensland (3pc).

Good rainfall and high commodity prices have driven strong farm financial performance for 2021-22.

Cropping farms report higher incomes

ABARES executive director Dr Jared Greenville said cropping farms had reported higher than average cash incomes over the last year.

“It’s been a boom year.

“At the national level, farm cash income for cropping farms is estimated to have increased by around 28 per cent to average $619,000 per farm in 2021–22,” he said.

“We can put this down to higher receipts from wheat, barley, oilseeds, and grain legumes.

“That said, prices are higher for farm inputs such as fuel and fertiliser, and this has affected returns and will do so even more into 2022-23,” Dr Greenville said.

“Ongoing productivity gains in Australian agriculture have helped drive the strong farm performance result in 2020–21.

“Over the long-term, average annual productivity growth in the broadacre industry was 1pc, and 1.3pc in the dairy industry,” he said.

“Looking beyond the averages, we see that broadacre sector performance is being driven by larger farms with the largest 10pc of broadacre farms producing around half of total output, while the smallest 50pc of farms produce around 10pc of total output.”

Financial performance of cropping farms 2019–20 to 2021–22 can be read here: https://www.awe.gov.au/abares/research-topics/surveys/cropping

Financial performance of livestock farms 2019–20 to 2021–22 can be read here: https://www.awe.gov.au/abares/research-topics/surveys/livestock

The Australian Agricultural Productivity 2020-21 dashboard can be accessed here: https://www.awe.gov.au/abares/research-topics/productivity/agricultural-productivity-estimates

The Disaggregating Farm Performance Statistics by Size dashboard can be accessed here: https://www.awe.gov.au/abares/research-topics/surveys/disaggregating-farm-size

Farm data portal can be accessed here: https://www.awe.gov.au/abares/data/farm-data-portal

HAVE YOUR SAY