A RECENT live sheep export forecast released by the Australian Bureau of Agricultural and Resource Economics was politically influenced, according to the peak exporter body.

After reviewing the difference between estimates of future live export volumes by ABARES and Meat & Livestock Australia, Australia Livestock Exporters’ Council chief executive officer Mark Harvey-Sutton believes the MLA figures are closer to what will be achieved with the advent of the Moroccan market.

The Albanese Government has continually sought to justify its decision to phase out live sheep exports by seas by stating that the trade is in decline, and Mr Harvey-Sutton said he believes the lower ABARES forecast was politically influenced.

“And the disappointing thing about the ABARES figures was for them to describe what is clearly an exodus from sheep production in Western Australia as a pivot to chilled and frozen product.”

On whether the forecasts had considered the advent of new markets like Morocco, Mr Harvey-Sutton said he appreciated MLA’s acknowledgment that there is demand for live sheep globally.

“And that continues to be the case.”

What ABARES said

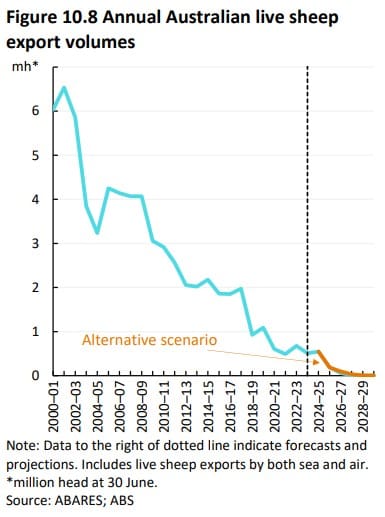

In its March quarter Agricultural Commodities Report, ABARES forecast live sheep export volumes to rise by 8 percent to 547,000 head in 2024-25 from 507,000 in 2023-24, reflecting dry seasonal conditions in Western Australia and increasing sheep turn-off.

ABARES said live sheep export volumes are forecast to decline by 40pc to 328,000 in 2025-26 as an expected contraction in the Western Australian sheep flock reduces the availability of sheep for live export. In an alternative scenario, ABARES predicted live sheep exports to decline at a faster rate than in the baseline scenario, assuming drier seasonal conditions leading to increased sheep turn-off, driving slightly higher live sheep exports until the legislated phaseout.

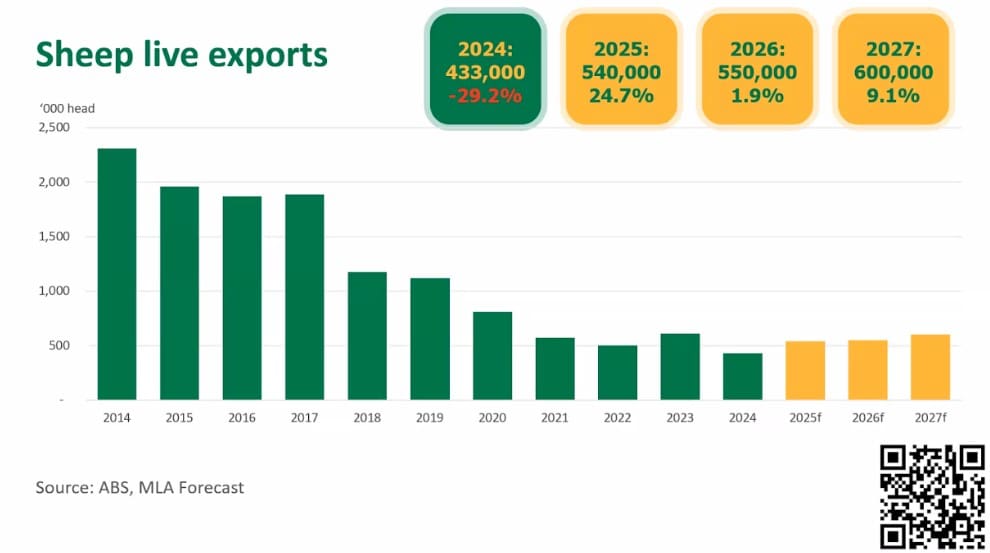

The ABARES figures contrast with Meat & Livestock Australia’s global supply analyst Tim Jackson stating that MLA expects a steady lift in live sheep export numbers over the forecast period to 2027.

“In 2024, exports were lower than expected for the large part due to significant supply chain disruption.

Given the resolution of several of these impediments towards the end of the year we expect the volumes will correct in 2025, with exports rising 25pc to 542,000 head,” he said.

“Following that we expect a marginal increase of exports in 2026 to 556,000 head, followed by a larger increase in 2027 to 600,000 head as supply improved.”

However, Mr Jackson said it is unlikely that live sheep exports will return to historic averages over the forecast period.

The reasons for this include the recent tough seasonal conditions in WA with adult sheep slaughter rising to a 15-year high in 2024, he said.

“While these projections are aggregated at a national level, we know from the Sheep Producers Intentions survey that the Western Australian percentage of the flock has shrunk relative to the national total.

”Secondly, there is an ongoing shift in the genetic composition of the (WA) sheep flock away from wool breeds and towards meat breeds,” he said.

“This tilts the age profile of the flock younger; instead of keeping wethers around to get a fleece, lambs are more likely to be processed.

“Taken together these two factors have reduced the available supply of adult sheep for live export,” Mr Jackson said.

“The third reason on the demand side is that terrorist activity around the Strait of Hormuz continues to pose considerable logistical challenges to accessing Australia’s largest live sheep export market, which pose an ongoing challenge to the supply chain and constrains exports.”

Mr Jackson said given the probability of a flock rebuild on the east coast of Australia and in South Australia, available breeding ewes and rams in WA will potentially be attractive stock for restocking in the second half of the forecast period.

“Taken together this means that although numbers will rise, they will not rise to or above the long-run average over the forecast period.”

MLA live sheep export forecast is supply-driven

When asked during a recent webinar if and to what extent MLA had incorporated an estimate for live sheep shipments to Morocco in its projections, Mr Jackson said: “So, not in the formal sense, in the sense that the model is fundamentally again, a supply-driven model.

“It’s based on a starting flock number and then kind of attaching what we know has actually happened as a result of that,” he said.

“We then are able to forecast with future flock numbers and future supply and production and so and so forth.

“So once we have those numbers … we then go out and do the fairly broad consultation and that’s where kind of all the details and factors come into play,” Mr Jackson said.

“Because if there are things that aren’t included in the model that then we do need to kind of consider, then we do think about those, but we don’t include it in the core kind of original numbers that come up.

“So to answer the question because it’s that supply-orientated model it’s definitely something that we’ve thought about, but we didn’t like formally generate an estimate or anything like that, that’s not how these numbers are put together, it’s fundamentally supply-driven.”

However, MLA market information manager Steve Bignell in consultations with industry, “it was noted with the numbers that the model does allow for the supply of animals to Morocco or a boat at least to Morocco in the 2025-2026 period.”

ABARES on live export to sheep meat in WA

ABARES said in recent years, Western Australian farmers have also shifted to processing meat domestically to meet growing global demand for boxed/frozen lamb and mutton.

Over the past twenty years, rising costs of sourcing live sheep from Australia – given both rising domestic saleyard prices as well as higher transportation costs associated with greater distance from key markets – have reduced demand for Australian live sheep in key markets, ABARES said.

ABARES said WA producers are expected to increasingly focus on exporting frozen/chilled boxed lamb and mutton, lowering the availability of sheep for live export. Producers, particularly on mixed farms, are expected to continue transitioning into cropping.

ABARES said live sheep exports by sea accounted for around 96pc of total live sheep exports in 2023-24 while live exports by air accounted for the remaining 4pc. Affected producers are projected to transition into sheep meat production for domestic processing and cropping as the phase out date approaches. This is consistent with a trend of falling live sheep export volumes over the past 20 years, reflecting a rising area planted to crops and a rise in demand for Australian sheep meat, ABARES said.

HAVE YOUR SAY