The Nutrien team selling lambs at Ouyen.

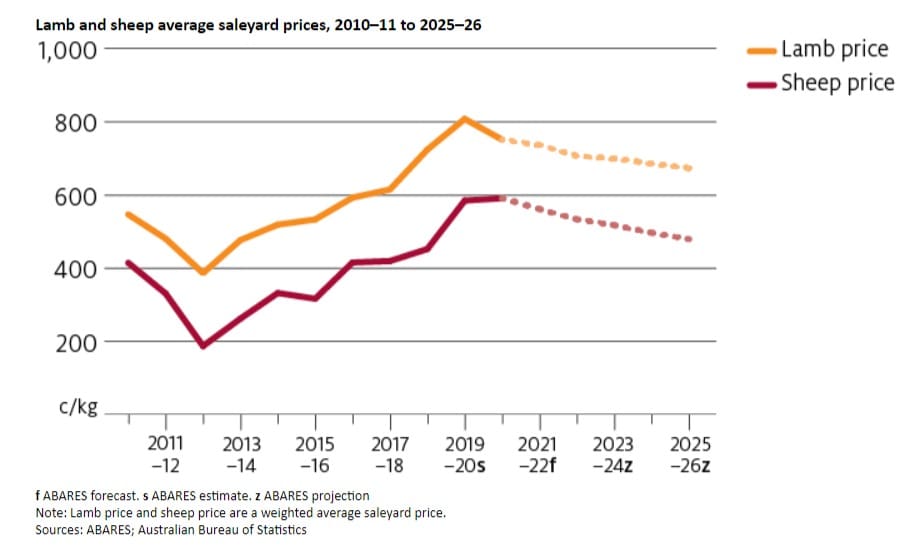

LAMB and sheep saleyard prices are forecast to fall over the next two years, but wool prices are expected to increase, according to the ABARES Agriculture Commodities March 2021 quarter report.

ABARES commodity analyst Mikayla Bruce said the saleyard price for lambs is forecast to average 751c/kg in 2020-21, down 7 percent from 807c/kg in 2019-20.

The saleyard price for sheep is forecast to average 590c/kg, up slightly from an average of 584c/kg in 2019-20.

Ms Bruce said limited supply of mutton and large-scale restocking are amplifying competition between processors and producers, leading to a sharper rise in mutton prices than lamb prices.

She said in 2021-22 the average saleyard price for lamb is forecast to fall just 2pc to 736c/kg and the mutton price average is expected to fall by 5pc to 561 cents per kilogram.

Drought-induced supply shortages and strong global demand driven by African swine fever are expected to begin to abate, leading to lamb price falls, Ms Bruce said.

In the medium term to 2025-26, Ms Bruce said lamb and mutton prices are unlikely to remain at the high levels of 2019-20 and 2020-21. But by 2025-26, lamb saleyard prices are forecast to fall by 10pc to 673c/kg and the saleyard price for sheep is forecast to fall by 19pc to 479c/kg.

“Global meat supply is increasing in response to high prices caused by Chinese import demand following the African swine fever (ASF) outbreak.

“This increased supply is expected to place downward pressure on Australian sheep prices over the medium term to 2025-26,” Ms Bruce wrote.

“Restocking efforts in the short term will increase the supply of lambs available in the medium term and reduce upward pressure on prices out to 2025-26.”

Ms Bruce said average saleyard prices in 2020-21 for lamb and sheep have been revised up from the December forecast, amidst stronger competition between producers and processors at saleyards.

Larger flock to boost sheep meat production

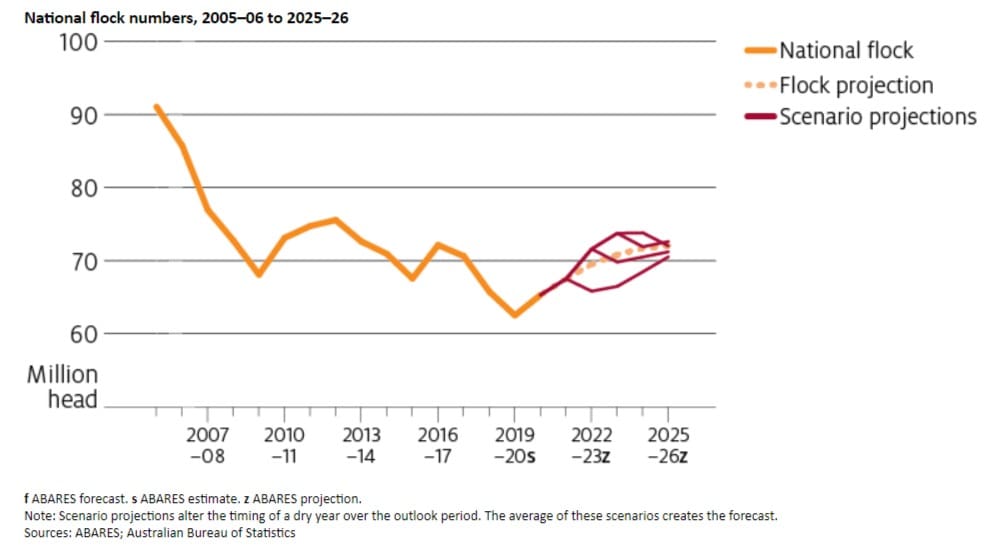

Ms Bruce said the national flock is forecast to reach 67.5 million in 2021-22.

In the medium term to 2025-26, the national flock is forecast to grow by 10pc to 72 million head, but growth in the national flock could vary between 7pc and 12c over the outlook period, depending on scenarios outlined in the commodity report.

“Faster growth is likely if favourable seasonal conditions occur early in the outlook period when prices are still high, boosting the incentive to restock.

“Slower growth will occur if drier seasonal conditions take place earlier in the outlook period and restocking occurs later when prices are lower, and when the incentive to restock is also lower.”

Sheep meat production is forecast to reach 647,000 tonnes in 2021-22, slightly down from 649,000 tonnes in 2020-21, Ms Bruce said.

“This fall is associated with lower lamb production, as a result of producers retaining female lambs for flock rebuilding.

“In the medium term to 2025-26, the larger flock and higher carcase weights (from improved genetics) are assumed to increase the supply of sheep meat,” she said.

In 2021–22 sheep and lamb slaughter are both forecast to fall as rebuilding takes priority, before increasing over the outlook period in line with the growing national flock.

Sheep meat production revised up

ABARES said production of mutton in 2020-21 has been revised up from the December quarter from 145,000 tonnes to 168,000 tonnes because steady demand has been met with supply, despite many producers shifting their focus to restocking.

“Likewise, sheep slaughter has been revised up by 16pc to 6.7 million head.

“The production of lamb has been slightly revised down from the December quarter to a forecast of 480,000 tonnes in 2020-21 and slaughter has been revised down by 4pc to 20.1 million head.

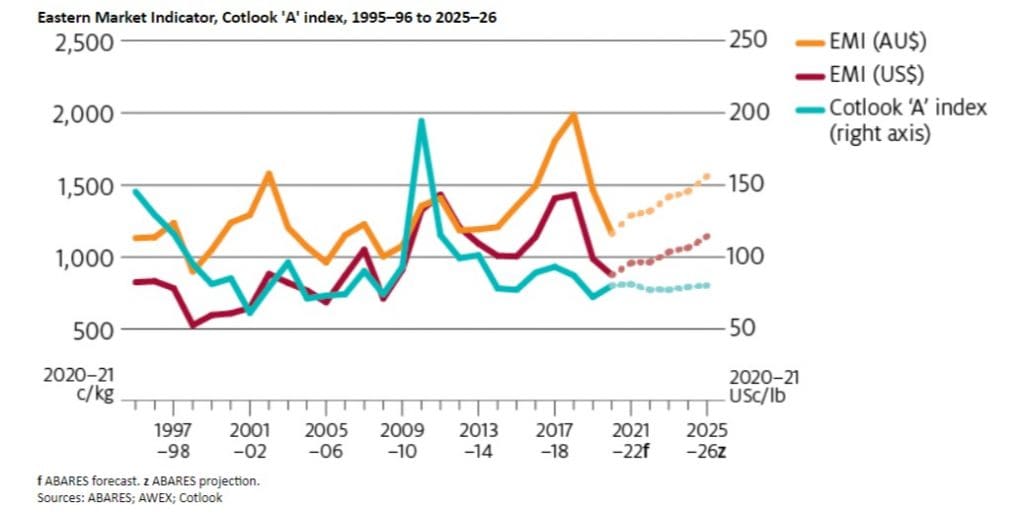

Wool prices to average 1300c/kg by 2021-22

ABARES commodity analyst Chris Mornement said the Eastern Market Indicator price for wool is forecast to average 1300c/kg clean in 2021-22, 12pc up from 2020-21, but 33pc lower than the peak in 2018-19.

Mr Mornement said lower consumer demand and supply chain disruptions throughout 2020 reduced demand for wool in textile manufacturing. As a result, wool prices reached near 11-year lows in late 2020.

“High price volatility throughout 2020 is consistent with the niche role that wool plays in world fibre markets.

“Stronger global economic growth over the medium term to 2025-26 is forecast to lead to higher wool prices, especially for superfine and fine micron wools used in woollen apparel,” he said.

ABARES has forecast Australian shorn wool production to rise by 2pc in 2020-21 to 288,000 tonnes.

“Continued favourable seasonal conditions throughout 2020-21 are forecast to lift fleece weights close to the 10-year average, offsetting the reduced number of sheep to be shorn nationally.

“Australian wool supply is forecast to continue increasing gradually from 2021–22 onwards, driven largely by flock rebuilding.”

ABARES said low auction offerings and clearance rates relative to the volume of wool tested throughout 2019-20 and 2020-21 resulted in stock accumulation both on-farm and in storehouses.

“In the short to medium term, wool price growth is expected to also be dampened by the supply of wool exceeding demand until stocks are cleared.”

Click here the ABARES Agriculture Commodities March 2021 quarter report.

HAVE YOUR SAY