AUSTRALIAN wool demand remained stable this week benefited by favourable currency exchange rates amid the uncertainty generated by American President Donald Trump’s global tariff pronouncements.

AUSTRALIAN wool demand remained stable this week benefited by favourable currency exchange rates amid the uncertainty generated by American President Donald Trump’s global tariff pronouncements.

Australia’s main wool market, China, is to be hit with tariffs of up to 145 percent for US-bound products and most other wool-buying countries are also subject to varying tariff levels as President Trump seeks to overcome trade imbalances.

The Australian Wool exchange said the auction market this week recorded an overall increase, heavily influenced by a sharp reduction in the Australian dollar (AUD) against the US currency.

Brokers offered 34,168 bales, 4261 fewer than the previous week, and 5pc were passed in.

“On the opening day of selling the Australian dollar was trading at US60.59 cents, down from US63.01 cents at the close of the previous series.

“With such a large fall in the AUD, industry observers were predicting a rise in the market, the only question was by how much,” AWEX said.

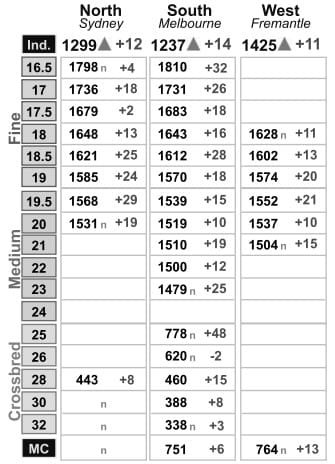

“By the end of the day, the individual Micron Price Guides for Merino fleece had risen by between 10 and 42 cents.

“These rises combined with increases in the skirting, crossbred and oddment sectors, resulted in a 15-cent rise in the benchmark AWEX Eastern Market Indicator,” AWEX said.

“These rises combined with increases in the skirting, crossbred and oddment sectors, resulted in a 15-cent rise in the benchmark AWEX Eastern Market Indicator,” AWEX said.

“Unfortunately, due to the weakened AUD, when viewed in USD terms the overall result was in stark contrast to rise to the physical market.

“The EMI fell by US21 cents, equating to a 2.7pc reduction.”

AWEX said this was the largest daily US cent drop in the EMI since January 2024.

“On the second day the AUD fell to US59.63 cents.

“This was the first time the AUD fell below US60 cents since the COVID-19 pandemic (April 2020).”

AWEX said with this further drop in the AUD, many predicted further rises in the physical market.

“There were some rises on the second day, but they were outweighed by the falls.

“The EMI dropped by 2 cents, closing the series 13 cents higher at 1262 cents/kg clean.”

In USD, the market retracted further, dropping another US13 cents, AWEX said.

“The EMI closed the series on US753 cents, a US34 cent drop, a fall of 4.3pc.”

Currency rate to the rescue – AWI

Australian Wool Innovation trade consultant Scott Carmody said alongside the rest of the world, Australian wool auctions operated under the most tumultuous week of confidence sapping factors seen for quite some time.

“The well-publicised tariff imposition by the USA on all its trading partners has caused absolute mayhem across all markets and the wool and textile world was no exception.

“All participants grappled with the potential outcomes and consequences of these third party actions,” he said.

“Our major trading partner in China was the most heavily targeted of nations, yet they stood tall in this week’s auctions and continued purchasing operations to a relatively normal, stable and well measured strategy.

“This helped impart confidence to the local operators and our largest trading exporter subsequently maintained a heavy buying rate,” Mr Carmody said.

“Thankfully in some sense, our ridiculously weaker Australian dollar against almost all other currencies on the foreign exchange (forex) boards stepped in to keep wool prices stable and in fact pushed dearer for the week in our local currency.

“The real story though was wool’s devaluation by 3.1pc to 4.2pc on a Chinese Yuan (CNY) and US dollar (USD) basis respectively and an even heftier 6.5pc lower value on buyers using the Euro,” he said.

“If things normalize from here on and those forex rates remain in play, this week could turn out to be a bit of a boon for sellers getting paid in AUD going forward.

“On the surface, wool is now looking good value in all those foreign currencies given the world was seemingly heading into lower inflationary and lower interest rates environment prior to this week’s events,” he said.

Mr Carmody said the 2021 IWTO produced figures show that the USA imported 20,867 tonnes out of the 219,793 tonnes imported by countries across the globe of finished wool and wool rich garments and fabrics.

“That represents 9.5pc of the world’s wool apparel/products from all nations’ so minimal increased consumption from the rest of the world’s consumer markets could easily absorb this rather than sell into the US at a 104pc tariff (China) or Italy at 20pc plus rates.”

There are currently 43,678 bales rostered for sale in Sydney, Melbourne and Fremantle next week, an increase of 18pc week-on-week. Next week is the last sale before the annual one-week Easter recess. Sydney will be holding a feature sale at the Sydney Royal Easter Show.

Sources – AWEX, AWI.

HAVE YOUR SAY