THIS week’s property review includes a wrap-up of interesting recent listings across four states.

Griffins list historic ACT sheep station

$20m anticipated for Southern Tablelands asset

Highly regarded NSW western division grazing

Coventry family seeking $16.5m for NSW’s Abberley

McBrides offload KI’s Calana

Qld’s Douglas family sells exclusion fenced Myrtlemount

Kambingila Pastoral sells a second Qld property

Griffins list historic ACT sheep station

One of the largest and oldest operating sheep stations in the Australian Capital Territory has been listed for sale by Tony and Helen Griffin after 27 years of ownership.

The 1194ha Uriarra Station has hosted numerous foreign dignitaries, including US President Richard Nixon.

It is located on the western edge of the Murrumbidgee River corridor near Coombs, 20km west of Canberra.

The property once hosted a cattle stud and currently runs a premium sheep grazing operation carrying around 10,000DSE on gently undulating land with views to Canberra and the Brindabella Range.

Colliers Agribusiness and Berkely Residential have been appointed to sell Uriarra Station via an offers to purchase campaign closing on June 18.

Colliers agent Rawdon Briggs is anticipating widespread interest from existing families chasing a pastoral holding close to a major service centre to land bankers.

“Given its proximity to Canberra, one of the fastest growing cities in Australia, Uriarra Station offers a significant potential future development opportunity.”

Uriarra Station is watered by numerous springs, creeks and dams, supported by a 4.7ha lake and an average annual rainfall of 724mm.

Infrastructure includes a 1860s renovated stone homestead, a four-bedroom manager’s home, a two-bedroom cottage, a four-stand shearing shed and steel sheep and cattle yards.

$20m anticipated for Southern Tablelands asset

One of the largest contiguous grazing assets in the Southern Tablelands region of New South Wales has been listed with a $20 million price guide.

The 1857ha Mt Hannibal, Kerrawarra and Tarlo Hill holdings are currently enjoying an excellent season. They are located 26km north of Marulan and 45km from Goulburn.

The three adjoining holdings – 576ha Kerrawarra, 420ha Mt Hannibal and 862ha Tarlo Hill – are suited to beef, sheep, prime lambs, dual-purpose cash cropping, and fodder and hay production.

They are offered with an estimated carrying capacity of 15,000 DSE. The breeding and finishing platform is currently running 600 cows and calves, and 1000 ewes.

The properties feature well-drained granite and basalt soils, with 50 percent (25pc to 30pc is arable) of the country is gently undulating and able to support mixed farming operations, and the balance of slopes and elevated ridgelines suited to grazing.

Inquiry is anticipated to come from producers, institutional natural capital investors and established family operators.

Inglis Rural Property CEO Sam Triggs said Mt Hannibal and Kerrawarra also offer future upside across multiple land use scenarios – from agriculture to eco-tourism and carbon.

“Featuring rare scale and strategic proximity to Sydney, Mt Hannibal and Kerrawarra will appeal to investors seeking land banking or alternative and diversified land uses.

“The property’s quality soils and reliable rainfall are suited to natural capital projects, including carbon and forestry, featuring a high Net Plantable Area (NPA),” he said.

Mr Triggs said existing zoning and title configuration allow for immediate subdivision.

“It would allow for three to four separate rural holdings, each with a residence, while the surrounding 20ha subdivision activity signals potential for longer-term rural lifestyle development (STCA).”

Across the holdings, water supply is secured via 35 dams, 2.5km of Tarlo River frontage, and 10km of double frontage to the Junction Creek, supported by 713mm of annual rainfall.

Infrastructure includes three homes, two steel cattle yards, a shearing shed, shearers’ quarters, numerous sheds and grain storage.

Mt Hannibal and Kerrawarra are offered for sale as a whole or as separate holdings via expressions of interest closing on May 23.

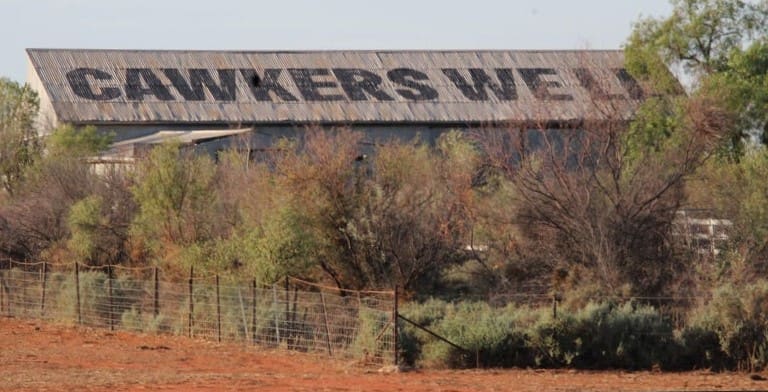

Highly regarded NSW western division grazing

Offers above $6.7 million will be considered for the Townsing family’s organically certified, prime New South Wales western division grazing country.

The 29,836ha Cawkers Well Station is 53km from Wilcannia and 151km from Broken Hill. it is being sold by the family after 19 years of ownership.

Cawkers Well is currently running 700 cows and calves on Mitchell grass plains. It is offered with an 8300DSE carrying capacity and an opportunity to muster and sell around 500 rangeland goats a year.

Nutrien Harcourts agent Troy Hartman is handling the expressions of interest campaign closing on June 16.

He said the operation is already attracting good local inquiry.

“Cawkers Well is highly regarded by locals as high carrying country that benefits from substantial flood out country from the Dolo and Grassmere Creek systems.

“With a large body of standing dry feed heading into winter, the property is in good shape going forward,” Mr Hartman said.

Cawkers Well is watered by six bores and six tanks and dams.

Infrastructure includes a three-bedroom home, a two-bedroom workers cottage, a four-stand shearing shed, a six-bedroom shearers quarters, yards and numerous sheds.

Cawkers Well is offered with some plant and equipment. The successful purchaser will have the option to purchase the Hereford breeding herd.

Coventry family seeking $16.5m for NSW’s Abberley

High rainfall New England grazing that failed to sell at auction has been listed for $16.5 million by the Coventry family after 30 years of ownership.

The 1595ha Abberley is a productive grazing property, currently running a 750 to 800 cow self-replacing beef herd, 24km south of Walcha.

The undulating country has a significant portion of arable land, that Ray White Rural agent Andrew Starr described as ideal for pasture development and fodder cropping.

Water is secured by double frontage to the MacDonald River and Bald Creek, the Cobrabald River and numerous dams.

Infrastructure includes a three-bedroom cottage, a shed, a four-stand shearing shed, two sheep yards and two cattle yards.

McBrides are offloading Kangaroo Island’s Calana

After a long ownership, the McBride family is selling its picturesque Kangaroo Island livestock opportunity due to a change of direction.

The 2211ha Calana is located near Cassini and is offered with a reputation for premium livestock production and fine wool growing at scale.

The property is situated in the reliable and highly regarded Cassini farming precinct. It has a blend of hills grazing, native shelter belts and arable cropping country.

While 1374ha are arable, the McBrides run around 6000 dry sheep equivalents plus 150 head of cattle with a 22ha centre pivot for fodder cropping.

Calana is watered by 37 dams and four rainwater tanks with 227,124 litres of capacity, supported by 620mm of average annual rainfall.

Infrastructure includes a three-bedroom home, steel cattle yards, sheep yards, a four-stand shearing shed and numerous sheds.

Nutrien Harcourts Andy Edwards is handling the walk-in walk-out sale that includes around 2000 merino ewes, 500 lambs and 1300 wethers, as well as plant, equipment and fodder.

He has already fielded good inquiry from producers across Australia seeking value for money and high rainfall country.

Queensland’s Douglas family sells exclusion fenced Myrtlemount

The Douglas family has listed its fully exclusion fenced grazing property in Queensland’s Western Downs region, capable of running around 1200 Adult Equivalents.

The 5216ha Myrtlemount is well-located with double frontage to the Moonie Highway, 58km west of Westmar and 60km east from St George.

It is close to major feedlots and livestock selling centres.

The country ranges from heavy grey brigalow and red belah, box and wilga soils, with some edible mulga ridges grassed with buffel and native pastures.

In the past, around 2833ha of cultivation was sown to dryland crops most of which is now established to improved pastures including bambatsi, digit, creeping bluegrass, vetch, panic and desmanthus.

Today around 130ha of cultivation is available for growing oats or improved pasture.

The property fronts the Moonie River and is upstream from the Myrtlemount Weir. It is offered with a 280ML water licence that is supported by numerous dams and an annual rainfall of 540mm.

Infrastructure includes a one-bedroom self-contained cottage, a two-bedroom quarters, two sheds, steel cattle yards, adjoining facilities for sheep and goats and good quality internal fencing.

Myrtlemount will be auctioned on June 12 by Resolute Property Group agent Ben Forrest.

Kambingila Pastoral sells a second Qld property

Kandimulla-based Kambingila Pastoral is selling a second southern Queensland property in just six months.

In November last year, it offered to the market the 5099ha Greenoaks, 25km from Dunkeld and 65km south of Mitchell, suited to cattle, sheep or goats.

The company has now listed versatile grazing and fodder cropping country that is fully exclusion fenced, 86km from St George and 125km from Roma.

The 5243ha Gowrie has a range of country types from black soil flats to red brown sandy loams with belah, box, ironbark and mulga and was fully re-fenced five years ago.

A 220ha cultivation area is suited to flood or lateral irrigation. Historically cropped to dryland barley, sorghum and lablab, in 2023 around 120ha were planted to hay.

Gowrie is watered by a bore and dams, including a 3000ML irrigation dam, supported by 506mm of annual rainfall.

Infrastructure includes a three-bedroom home, donger accommodation, cattle and sheep/goat yards and numerous sheds.

Gowrie is offered for sale by expressions of interest closing on June 10.

Resolute Property Group agent Ben Forrest is handling the sale.

HAVE YOUR SAY