Southern Aurora Markets partner Mike Avery.

“You must exercise your caution in laying your plans, but be bold in carrying them out” – P.T. Barnum

WOOL’S spot auction market trundled along posting positive movements across most micron qualities this week.

The tight supply is being matched by adequate deman as external influences continue to ebb and flow.

The Australian dollar’s value remains steady around US64 cents. The 25-point rate cut by the Reserve Bank was in line with market expectations. Tensions remain high in all flash points around the world and the Washington circus rolls on.

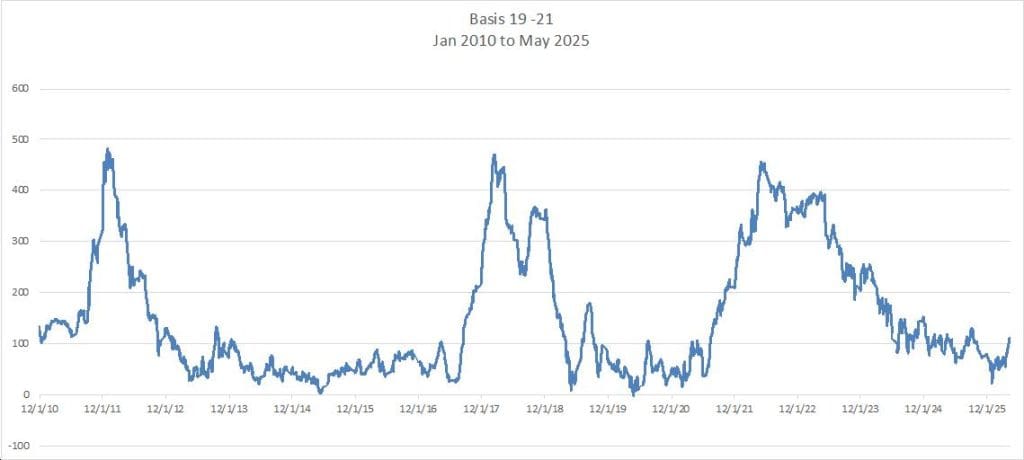

The forward wool market had its own wanderings. The lack of liquidity is making it difficult to scrutinise. The week started dominated by sellers, albeit cautious in their levels. Buyers temporarily buoyed by a solid start to the auction paid a 20-cent premium to cash for cover in the spring on 19 and 19.5 micron contracts.

Even though there was no follow through on the buy side sellers generally backed away. This situation stayed in place until the close of auction Wednesday.

With the pipeline still circumspect, buyers set levels across the curve relative flat from the point of view of maturity. June through to November are bid roughly at a 10-cent premium to cash. This is consistent across the microns from 18 micron through to 21 microns. This would suggest that little change is predicted in the tight basis between microns that is currently in place.

Another week of tight supply next week with around 28,000 bales on offer throughout Australia should see a continuation of the firm tone to the market. Opportunities to hedge at a slight premium should remain prior to the auction opening Tuesday. Unfortunately, depth remains shallow.

Trades this week

19 micron September 1555 cents 5 tonnes

19.5 micron November 1525 cents 10 tonnes

19 to 21 micron basis chart. Bidding levels in spring indicating a maintenance to the current level of around 110 cents.

Source ; Southern Aurora Markets.

HAVE YOUR SAY