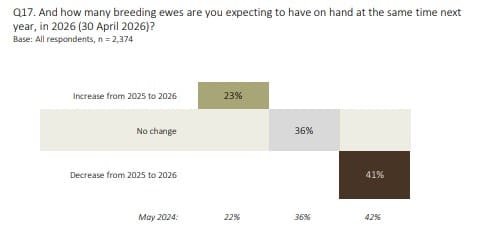

AUSTRALIAN sheep producers have indicated the national ewe flock will decline 9 percent to 44.34 million by next year, despite improved sheep meat sector confidence, but with generally negative wool producer sentiment.

AUSTRALIAN sheep producers have indicated the national ewe flock will decline 9 percent to 44.34 million by next year, despite improved sheep meat sector confidence, but with generally negative wool producer sentiment.

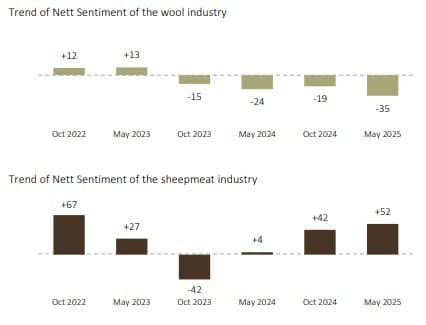

Among the 2374 producers participating in the latest Sheep Producers Intentions Survey conducted by Meat & Livestock Australia and Australian Wool Innovation a net sentiment score of +52 for the sheep meat industry was noted, up 48 points from the same time last year.

MLA said the May 2025 results reflect a significantly more pessimistic outlook from producers about the future of the wool sector (Nett Sentiment: -35, down 16 points since October 2024 and 11 points since May 2024). Almost one in in two (46 percent) producers had a negative outlook for wool. The predominant negative outlook is consistent across all states and across farms of all sizes, MLA said.

The latest survey marks the first time since October 2022 that all states, including Western Australia, have reported positive or neutral sentiment. Western Australia, which had a net sentiment of -64 in May 2024, has now reached neutral ground at 0 net sentiment. Other states’ levels include:

- New South Wales: +60

- Victoria: +58

- South Australia: +56

- Tasmania: +55

- Queensland: +53

- Western Australia = 0

MLA’s senior market information analyst, Erin Lukey, said the strong sentiment among sheep meat producers is closely tied to improved prices across the country.

“Prices have risen significantly, particularly for finished lambs, which has buoyed confidence even as producers face tough seasonal and regulatory conditions.

“This is especially the case in Western Australia, where the rebound in sentiment has been most pronounced,” she said.

Ms Lukey said drought in the south and flooding in the north are making it more difficult and expensive to maintain large flocks.

“Weather remains the most cited factor influencing on-farm decisions, with significant drought in South Australia, Victoria and southern New South Wales reducing pasture availability and increasing feed costs.”

The survey found that the forecast ewe flock fall is greatest in Western Australia, down 19pc, with 58pc of producers in the state planning to reduce numbers.

Ms Lukey said many producers are taking a more conservative approach.

Ms Lukey said many producers are taking a more conservative approach.

“Nationally, 41pc of surveyed producers said they will reduce their breeding ewe flock, and 26pc plan to reduce their wether numbers.”

Ms Lukey said input costs, labour availability, and regulatory pressures, particularly the live sheep export phase-out, are weighing heavily on producers’ minds.

“While producers in Western Australia are wary of investing in flock growth amid uncertainty about future market access, others are adjusting breeding strategies or retaining more replacement ewes to adapt to changing conditions.”

However, Ms Lukey said producers are adapting.

“Whether it’s retaining more replacement ewes, adjusting breeding strategies, or responding to market demand, the sector continues to evolve.”

MLA said the SPIS is a critical tool for industry planning, providing valuable insights for producers, processors, and policymakers alike.

“This data helps us understand where the industry is heading and how we can support producers through change,” Ms Lukey concluded.

View a full copy of the May Sheep Producers Intentions Survey here: Sheep Producers Intentions Survey May 2025

HAVE YOUR SAY