RISING livestock prices are expected to be offset by lower livestock-derived export volumes in 2025-26, according to the latest ABARES June quarter outlook.

But the high season-impacted mutton kill and expected lower lambing rates are coming at a time of continuing strong world demand for sheep meat, especially in the Middle East.

ABARES said while US president Donald Trump’s tariffs have the potential to weigh on US and Chinese demand if consumer prices rise, growing global demand for sheep meat – especially from the Middle East – demonstrates the diversity of Australia’s global trade flows.

“Australian sheep meat exports to the Middle East in 2023-24 and 2024-25 to date (July-March) are 97pc higher than the previous five-year average, supported by rising incomes and shifting consumer preferences towards animal proteins.”

The United States and China are currently Australia’s largest markets for Australian lamb and goat meat, comprising 41pc of the total value of Australian exports in 2023-24.

“The US and China are reliant on Australian sheep meat exports to service their own domestic demand, sourcing 70pc and 47pc of total sheep meat imports from Australia, respectively.

“Notably, Australia supplies 80pc of the lamb imported into the US, a market relatively of high value focused on premium priced lamb racks, short loins and legs of lamb,” the agency said.

“In addition, the US is Australia’s largest goat meat export destination accounting for 44pc of the value of exports in 2024–25 to date, with China accounting for 15pc.

ABARES said world sheep meat supply in 2025-26 is expected to tighten, driven by lower production in Australia and New Zealand.

“New Zealand sheep meat production is forecast to fall in 2025-26 due to increased competition from environmental programs and the beef industry for land use.

“The New Zealand Government estimates that the sheep flock at June 2024 was 23.6 million head, 21pc below the flock of 10 years prior.

Livestock export value to fall as saleyard prices rise

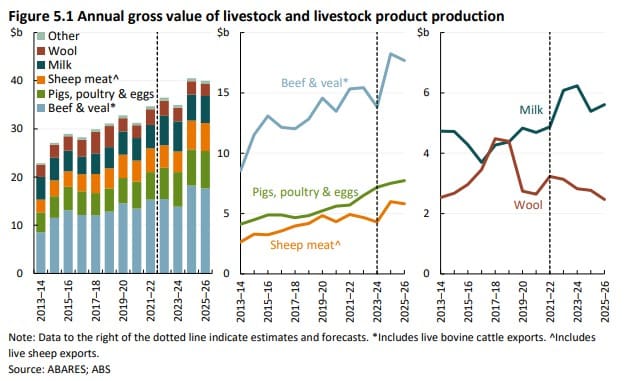

ABARES is forecasting the value of livestock and livestock product exports to fall to $31.2 billion in 2025-26, down by 7 percent from 2024-25.

ABARES said the lower forecast export values across most livestock and livestock products reflect lower export volumes more than offsetting higher export prices.

The Federal Government agency said the forecast fall in total livestock and livestock product export values in 2025–26 is driven by beef, veal and live cattle (down by 8pc to $15.2 billion), sheep meat and live sheep (down by 9pc to $5 billion), dairy (down by 10pc to $3.3 billion) and wool (down by 7pc to $2.5 billion).

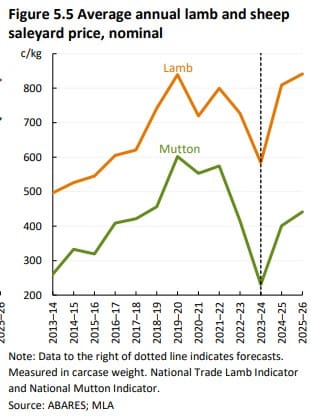

ABARES is forecasting lamb and sheep saleyard prices to rise in 2025-26 given strong saleyard demand from restockers and processors. In addition, expected tightening supply of lamb and sheep to saleyards – due to successive years of high turn-off – is also placing upward pressure on prices, the agency said.

Average lamb saleyard prices are forecast to rise by 4pc in 2025-26 to 841 cents per kilogram cwt, up from the 809c/kg in 2024-25. It said the 2025-26 forecast is 3pc above the 10-year average in real terms.

ABARES is forecasting average mutton saleyard prices to rise by 10pc in 2025–26 to 441c/kg, up from 401 c/kg cents per kilogram in 2024–25. The 2025–26 forecast is 17% below the 10-year average in real terms.

Wool prices to fall further

ABARES said the wool price benchmark, the AWEX Eastern Market Indicator, is forecast to fall by 2pc to 1142c/kg clean in 2025-26 as lower global demand is expected to more than offset falling domestic production.

“Lower global wool demand reflects forecast lower income growth and consumer confidence in key overseas markets, including China, the United States, and other advanced economies.

“Global uncertainty and geopolitical tensions – including any impact on global economic activity – pose a downside risk for global textile consumption, particularly for discretionary items like woollen products,” ABARES said.

ABARES said world demand for wool is expected to fall by more than the forecast fall in supply, driving lower wool prices in 2025-26.

“A weaker outlook for income growth and consumer confidence in China, Italy and other advanced economies is expected to weigh on woollen product consumption, driving down global demand.”

Mutton kill still high

ABARES is forecasting Australian sheep meat production volumes to decline by 7pc to 867 thousand tonnes cwt in 2025-26 driven by reduced slaughter rates.

Lamb production is expected to fall by 8pc in 2025-26 due to elevated adult sheep sales this year reducing the breeding flock. Below average rainfall and pasture growth across much of south-eastern Australia in 2024-25 is expected to reduce lambing rates and the ability for producers to finish lambs to meet prime market specifications.

Mutton production is forecast by ABARES to decline 5pc in 2025-26.

“However, the proportion of mutton processed as a share of total sheep meat remains elevated, with the quarterly adult sheep kill at over two million head for 10 consecutive quarters.

“In March 2025, adult sheep accounted for 44pc of the total sheep and lamb slaughter, above the 10-year average of 36pc.”

ABARES flock estimate model coming in 2025

ABARES is forecasting the Australian sheep flock to decline by 2pc to 64.8 million head in 2025-26 due to increased turn-off of older sheep and lower lamb retention.

“Dry conditions in 2024-25 in the main sheep producing states of New South Wales (39pc of the national sheep flock in 2021-22), Victoria (21pc) and South Australia (15pc) will negatively impact lamb marking rates.

“Sustained processing demand and high saleyard prices are also keeping turn-off elevated.”

ABARES sad partially offsetting the decline in sheep numbers are forecast improvements in climatic conditions in 2025-26 in Western Australia and the increasing influence of sheep meat breeds in the flock, leading to higher lambing rates per ewe.

ABARES said its new Australian Bureau of Statistics Sheep Flock Model estimates are expected to be released in 2025.

“ABARES sheep flock forecasts are based on ABS 2022 flock estimates.

“The ABS is currently developing a method to estimate sheep populations, adopting similar stock/flow modelling principles used in experimental cattle herd estimates,” the agency said.

“The data are scheduled for release in 2025 with ABARES sheep flock forecasts to be updated when the new estimates become available.

Middle East to feature in sheep meat demand growth

ABARES said world sheep meat demand is forecast to remain strong in 2025-26, driven by China and the Middle East.

“China’s demand for sheep meat is forecast to remain robust due to strong preferences for mutton amongst sectors of the population.

“In March 2025, an additional 17 Australian sheep meat processors were granted licences to export to China, supporting future trade.”

ABARES said Middle East demand for sheep meat is forecast to rise in 2025-26, reflecting a continuation of trends in population growth, rising incomes, shifting dietary habits and an expanding tourism sector.

“Demand is expected to rise for both lamb and mutton following high demand in 2024–25 resulting in record Australian export volumes to the region.”

Australia is the world’s largest exporter of sheep meat, accounting for around 40pc of total global exports in 2023-24.

ABARES is forecasting live sheep export volumes in 2025-26 to decline slightly to 375,000. In 2024-25, Australia is forecast to export 395 thousand sheep, with Kuwait, Jordon and Saudi Arabia the main export markets.

Overall ag production value to fall 2.8pc

ABARES said the gross value of Australia’s agricultural production is expected to fall by 2.8pc to $90.7 billion in 2025-26, driven by lower crop and livestock production volumes, but is tipped to be the third highest on record and worth $97.5 billion when fisheries and forestry are included.

ABARES executive director Dr Jared Greenville said favourable seasonal conditions across northern NSW, Queensland and southern Western Australia had provided a strong start to the 2025-26 winter cropping season.

However, production outcomes across South Australia, western Victoria, southern NSW and northern cropping regions of Western Australia – where much of the winter crop has been dry sown – rest on a knife’s edge and are highly dependent on the positive rainfall outlook for many of these regions.

Dr Greenville noted Australian export volumes were expected to be resilient despite subdued global demand and uncertainty around global trade policies.

“Australian agricultural exports are expected to be supported by tightening global grain stocks, demand for Australian red meat and a relatively low Australian dollar,” he said.

ABARES is forecasting average broadacre farm profit to fall to $141,000 but remain above the 10-year average, driven by predicted falls in broadacre cropping and livestock production.

In addition, record flooding last month across the Hunter, Mid-Coast and Northern Rivers regions of NSW is expected to result in losses to livestock, farm infrastructure, and disruption to the production and supply of milk from affected dairy farm across the region.

Despite significant challenges from an uncertain trade environment, flooding and risks around rainfall – the outlook for Australia’s farm sector remains strong with the value of production expected to be the third highest on record in 2025–26, ABARES said.

For more information, visit Agricultural outlook – DAFF and Australian Crop Report – DAFF

HAVE YOUR SAY