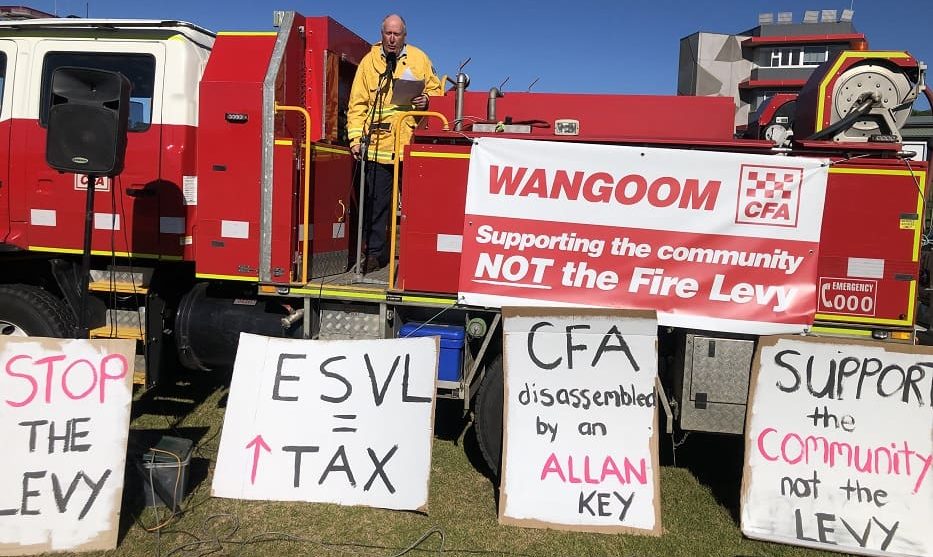

CFA volunteer and former shire mayor Don Robertson addresses the Warrnambool rally.

VICTORIA’S councils are opposing the State Government’s emergency services levy, but have stopped short of refusing to collect the controversial tax.

Just before thousands of volunteer firefighters and farmers rallied against the levy in Melbourne and in Warrnambool on Tuesday this week, the Municipal Association of Victoria resolved to oppose councils being the collector of the levy for the government.

However, despite some ratepayers declaring they would not pay the levy or even their rates, MAV president Cr Jennifer Anderson said it is now legislated that councils must collect the levy.

“So we really can’t do anything other than work the best we can with what the State Government has come up with, but we are still advocating strongly that really the State Government should be the collector of this tax.”

Last Friday, 79 councils met at MAV’s State Council to discuss the State Government’s Emergency Services and Volunteers Fund and resolved it would oppose councils being the collector on behalf of the State Government.

The MAV also wanted the State Revenue Office to collect the Principal Place of Residence component of the ESVF, instead of councils, and for the government to fully reimburse costs incurred by the local government sector for the collection, reporting and debt recovery services.

The councils also resolved to ensure that the levy is equitably structured and does not disproportionately burden rural communities or primary producers.

The MAV wants the Victorian Government to undertake community engagement directly with communities and “continue efforts to reduce the levy burden on all Victorian residents, ensuring the model remains equitable for all communities, especially rural areas and primary producers, reflecting the adjustments made to the Primary Production Land (PPL) rate.”

The MAV wants the Victorian Government to implement a comprehensive communication strategy to clarify the levy’s purpose, allocation, and impact on ratepayers and provide a publicly available statement detailing the reasons for changes to the fire services levy, including justifications for any fee increases from 1 July 2025.

The councils also resolved to ask the government to undertake periodic economic impact assessments to evaluate how levy changes, including adjustments to the PPR and the primary producer rebate, affect residents, businesses, and the broader community. The findings of these assessments should be released publicly to ensure ongoing transparency and facilitate informed decision-making for future policy revisions, the MAV said.

The MAV also wants the government to deliver a needs-based equalization approach for the distribution of ESVF funds, ensuring that rural and regional emergency services, which are disproportionately impacted by natural disasters, receive adequate and timely funding.

Councils have not decided not to collect the levy

Cr Anderson told Sheep Central the MAV believes the levy is not the right method to fund emergency services.

“Everyone agrees it would be great to have more funding to support our emergency services, but adding an extra tax burden on our ratepayers and adding that extra burden to local government is not the way to go about it.”

Cr Anderson said the MAV resolution is not a determination that councils will not collect the levy on behalf of the government. She said the resolution was an amalgamation of 18 motions concerning the levy and was considered the day after the enacting legislation was passed.

“So that’s where we got to basically stating we don’t think it is appropriate, State Government should do it, but if councils have to do it – so we covered all our bases – this is what we would ask for.

“If we can’t stop the State Government from making us collect this, we need them to fully pay for, fully, supporting the councils to be able to do it, so councils are not out of pocket, which means ratepayers are out of pocket for the services, which might mean that there are things that councils can’t do and promised they would do for their community.”

However, she said with the mandate of the MAV members the association would “continue to have conversations with the State Government.”

“We’ll just keep talking to State Government and try and get the best outcome we can through our councils and our communities, which is what we always do.”

Cr Anderson said councils are yet to get the full details of the fund’s administration and said there was no talks between councils and the State Government about the levy before it was legislated.

A rally of 50 CFA brigade trucks plus private units and about 300 CFA volunteers through Warrnambool to the city’s showgrounds on Tuesday coincided with a larger gathering in Melbourne.

Volunteers are in the fight for the long haul

Grasmere brigade captain John Houston.

Warrnambool rally organiser and Grasmere brigade captain John Houston said those at the rally should leave the rally with a determination to take their fight against the levy a lot further.

“We are in this for the long haul; we are taking this right up to the next election.”

Mr Houston urged the volunteers to contact their MPs and the Victorian Premier Jacinta Allan to oppose the levy.

“We will vote them out and we will put in a party that is going to support us, look after us and respect us.

“Please get their phone numbers, get their email addresses … get onto them …. Just keep hounding them,” he said.

“Because the more we do it, the likely we are to get a result.”

Mr Houston said volunteers are discussing not paying the tax or their rates.

“We need to make a stand, it’s not fair.”

Although Mr Houston said at least 250 CFA volunteer brigades had rendered themselves offline over the tax, he believed many would come back online.

“But what I worry about is that a lot of brigades, especially in the north, are just going to park their trucks up and that’s it.

“We are 100 percent supporting our community, we are supporting the cause.

“I’m in the fire brigade and if my neighbour’s house is on fire or he has an accident I will be there for him – that does not change,” he said.

Former CFA board member, CFA volunteer and former Southern Grampians Shire mayor Don Robertson said the fund is “unjust unfair and unacceptable” and “unfairly punishes us.”

“It is projected to raise an extra $2 billion, rural communities will pay the prices contributing 75 percent of that, according to Rural Councils Victoria.”

Mr Robertson said the CFA volunteers have to “maintain the rage.”

“In three months’ time we have to be still gathered together in anger.”

Mr Robertson would not speculate how many CFA volunteer units would remain offline, and he expected that groups will still have the ability to call on some brigades to respond to fires.

“But what they won’t do though is co-operate as well as they have in working strike teams across the state, across New South Wales, across South Australia or fly into Queensland.

He believed such interstate co-operation would be “totally off the table” until the levy issue was settled.

“Which is why we need people like (Wannon MP) Dan Tehan and all our federal members, whatever flavour, to start taking notice of what’s happening here.”

Bulart farmer Adrian Quinn said the only way to oppose the tax is for farmers to get together and not pay “the excess” that rural landowners are being charged.

“The only way we are going to stop this is to not pay and we can do that with our rates.

“We don’t mind paying our fair share, but what they are putting on us now is just wrong and the only way it is going to stop is if people draw a line in the sand and say ‘enough is enough’.”

Steve Giblin from the Koroit Fire Brigade said the time to take further action will be when ratepayers get their rate notices and realise they should have been rallying with the volunteers.

“Because they are going to financially impacted to a greater degree than what they think they really are.

“The whole marketing campaign behind this new tax has been top let the farmers take the brunt of it and don’t worry about it, they are the ones who are going to pay – everyone is going to pay.”

Volunteer firefighters and farmers at the Warrnambool rally.

Local Government is a created by State Government legislation. Local Government has no recognition under the Australian Constitution and is compelled to do as the State Government legislation directs. Councils contemplating not collecting the fire services levy are misguided.

However, I am surprised that no one has grasped that the so-called fire levy has now become a method of raising general revenue. At that point it became a land tax and thanks to Henry Bolte, agricultural land is exempt from land tax in the State of Victoria.

This tax is in my view illegal; a matter that should be tested before the Victorian Supreme Court.