WA sheep farmer and consultant Lucy Anderton on the job

WESTERN Australia’s top mixed sheep-cropping farms are the most profitable in the world, according to an agri-benchmark report released by Meat & Livestock Australia today.

The report — How are global and Australian sheep producers performing? also found that Australia has some of the lowest cost sheep meat producers in the world.

And although sheep meat production is growing in China, Central Asia, North Africa and the Middle East, report co-author Lucy Anderton said Australian sheep meat producers had a competitive advantage. Her co-author was New South Wales consultant Peter Weeks.

However, the report found maintaining a low cost of production and diversified enterprises on Australian farms is vitally important to preserving the viability of a sheep enterprise, particularly as climate variability continues to be one of the main challenges.

The results from the agri benchmark data indicate that Australian mixed farming operations are responding well to climate challenges and showing a high level of resilience.

However , Ms Anderton said the reasons for Western Australia’s declining sheep flock included the higher profitability and ease of cropping, farmer decisions to reduce sheep numbers to simplify management systems, and severe stock water shortages in some areas.

“The water issue has been the nail in the coffin for a lot of people who have sold their sheep or reduced numbers.”

Ms Anderton said many WA sheep flocks also lost their economies of scale as the more area was cropped.

“Whereas before in the mixed farming enterprises the sheep played a really important part in risk management and in weed control – there were real synergies in the mixed farming.”

Ms Anderton and Mr Weeks said the strong post-drought demand for restocking sheep in the eastern states has also increased the number of WA sheep being sold.

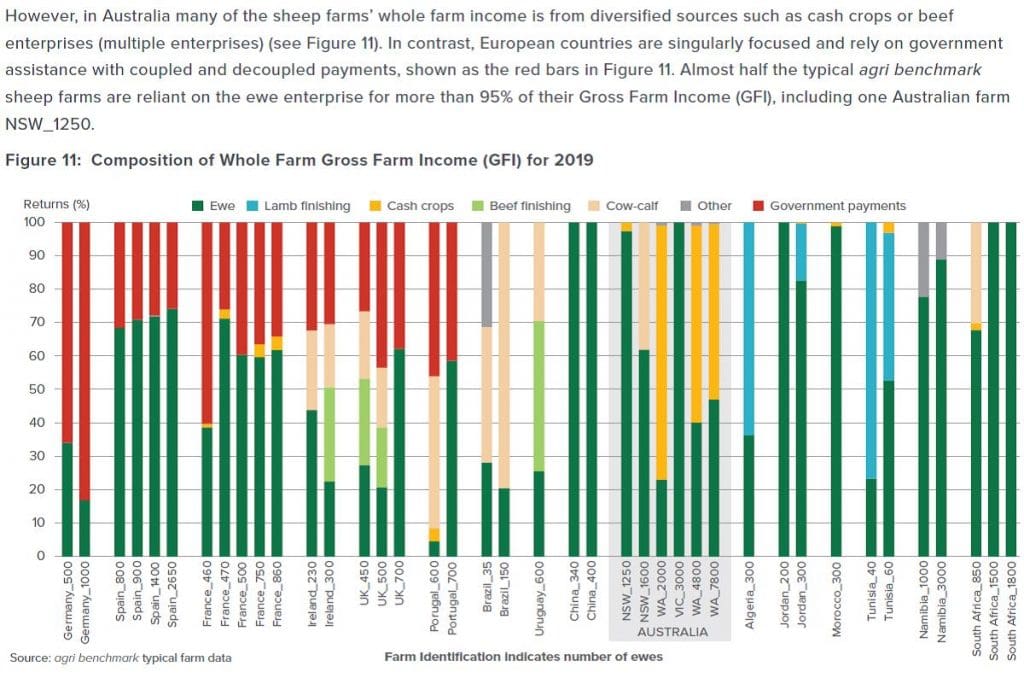

“The prices people were paying for sheep in the east made it a very attractive proposition for farmers in the west to offload,” she said.

Mr Weeks said there has been intense restocking demand for breeding sheep after a series of eastern state droughts, initially from the New South Wales and Victorian sheep numbers, and then from WA flocks.

“This intense recovery from the drought will probably go on for maybe two years and then you will find that prices will slip down a bit and the intensity will go out of the restocking demand.”

Ms Anderton said as wool prices rose before the COVID-19 pandemic hit, WA sheep producers were increasing their flocks. She said the WA sheep enterprises in the agri-benchmark study were true representative mixed farms in their region with cropping and a sheep focus.

What should sheep producers take home from the report?

Ms Anderton said her message for farmers from the analysis was that the Australian sheep industry has a global competitive edge.

“And it’s a shame that the Western Australian farmers don’t understand this, because compared to anybody else around the world we can do sheep best and we can do it at low cost, we’ve got the scale, and there is a really high demand for quality sheep meat.”

She said although WA farmers were becoming very good at growing grain, Canada and the US are very good at grain growing, whereas Australian is very good at sheep production.

“As an industry we have a real competitive advantage, but because you have all these other things happening in the background overshadowing this, that’s why we (in Western Australia) have got these deteriorating numbers of sheep.”

She said Australian sheep producers should focus on improving productivity and keeping costs under control.

“We’ve got room to improve our lambing percentages and our productivity, and do things better.

“And I think there is an opportunity in the sheep industry to take up technology, which I think is happening.”

She said there are also opportunities to improve enterprise feedbase, pastures and Autumn/Summer feed gap management.

Mr Weeks said the formula for a profitable sheep flock in Western Australia was “working pretty well.”

Ms Anderton said the WA sheep producers were mating up to 30 percent of their Merino ewes with terminal sires and Border Leicesters for first cross ewe production. Merino-Merino matings increased when wool prices improved, but were likely to decrease due to lower wool prices and continued high prime lamb prices.

Report is positive for flock rebuilding, with China’s help…

Both consultants said the report’s finding also augur well for increasing the national sheep flock.

“There is high demand for sheep meat and that is not going to go away.

“We have a growing Moslem population and the Chinese haven’t stopped exports of sheep meat (from Australia) and they know they can’t do that really,” she said.

“Whereas they know they can get grain elsewhere and they know they can get the barley from elsewhere.

“There are certain place they can get sheep meat from in any quantity and that is from Australia and New Zealand.”

The agri-benchmark report compared the costs, productivity and profitability of Australian sheep farms with international competitors in 16 other countries. Six farms across key Australian sheep-producing regions participated, including three WA farms that were mixed sheep-cropping enterprises.

The WA mixed farming properties were some of the most profitable in the world and were also among the lowest cost of the world’s sheep-producing countries – all performing below the global average cost of production (which is US$482 per 100kg live weight production).

The report highlighted that sheep are integral to profitable mixed farming enterprises, however, as with Australian cattle farms, high land prices are putting pressure on sheep farms’ long-term profitability.

The report said that in the past decade, international sheep meat production has grown significantly in China, Central Asia and North Africa – most notably in Algeria, Uzbekistan, Chad, Sudan and Turkey. From a demand perspective, in the 10 years to 2019, global demand for sheep meat grew by 2.2 million tonnes carcase weight (cwt).

Australian ewes are the top producers

Australian ewes rated the highest in the world, with close to 100kg of live weight produced per ewe over their lifetime. The high productivity of Australian ewes is what drives the profitability of Australian farms, the report said.

On the other hand, weaning rates among the Australian flock were generally lower than the global average. In some countries like the UK and Ireland, weaning rates of 160 percent are being achieved.

Australian sheep farmers pay less for supplementary feed

The report found that Australian sheep farms generally pay less for stock feed compared to global competitors; however, this can be attributed to the fact that half of Australian sheep farms are mixed cropping enterprises that don’t need to buy feed and can feed sheep on crop stubbles.

Australian sheep farms also have higher machinery input costs than competitors. This is explained by the high percentage of mixed sheep and cropping farms in Australia that require costly seeding and harvesting equipment, the report said.

Source: MLA.

HAVE YOUR SAY