Southern Aurora Markets partner Mike Avery.

IT was a tough week for the wool auction market and a frustrating week for forward trading.

All qualities lost ground at auction, apart from the superfines (16.5 micron) and the Merino cardings.

Generally, the falls were between 1-3 percent, with 19 micron and coarser losing between 30 and 50 cents.

Activity on the forwards was erratic. Strong bidding across the two key strips, 19 and 21 micron, was met with resistance from sellers. Both micron groups were bidding around cash from June 2022 to June 2023, but attracted little interest. Small quantities of 19 micron were traded into to new season, with August trading at 1740 cents and October at 1740 cents and 1755 cents. The 19 micron price guide for the spot auction closed the week at 1716c/kg clean, down 55 cents.

The lack of activity in the forwards was surprising. The one consistent in the market commentary across the board has been that uncertainty that prevails. That uncertainty is coming from a number of directions. Logistical problems hound the pipeline from the shearing shed to the mill. This is stretching exporter funding, with cycle times constantly blowing out.

Larger auction volumes have added to the financing problems. Volatile currencies and stock markets add a further layer of complexity.

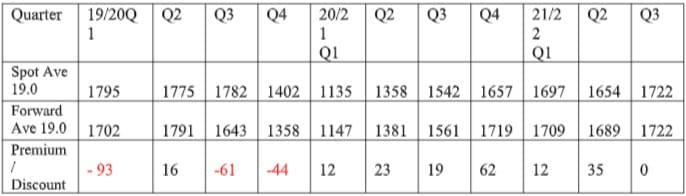

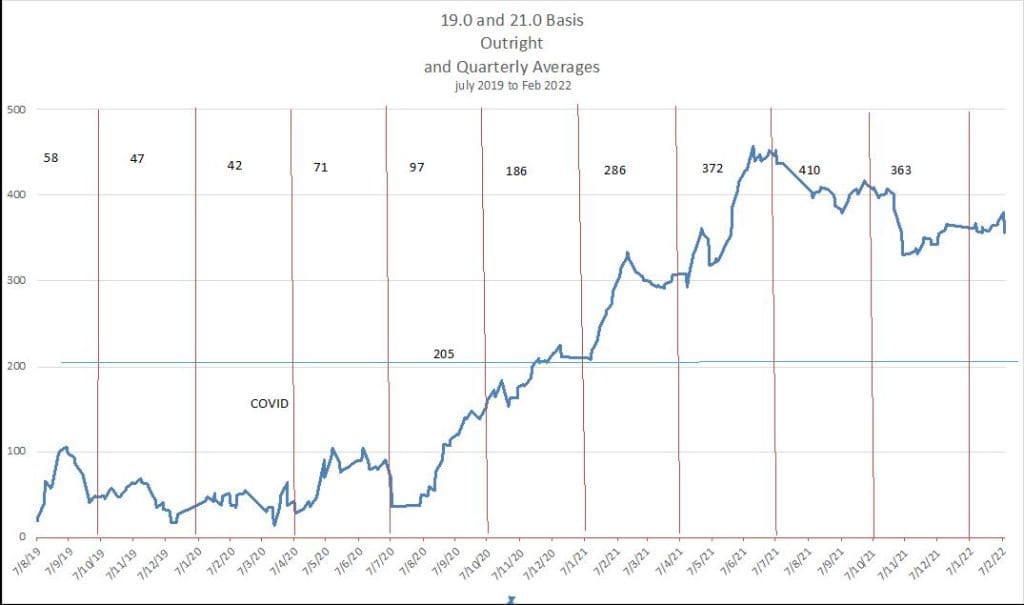

Why growers are not looking to lock in some certainty for a portion of their future clip remains a mystery. This is especially interesting when we compare the average quarterly prices of the spot and forward markets since July 2019. Pre-Covid, with a higher price structure, the forward market traded in discount. This remained the case until the market found a base. The forwards traded at a premium to average spot for the next six quarters. So far this quarter it is running flat to spot.

We are now in a price range approaching pre-Covid levels. Some hedging at these price points, especially on 19 micron and finer seems prudent. Hedging is not about trying to pick the top of the market, but about managing margin and valuing certainty over the fear of lost opportunity.

With over 50,000 bales rostered for next week it likely that the market will struggle to hold a base. That said, bidding on the forwards remains reasonable on the medium qualities. Both 19 and 21 bid 20 under cash for March/May/June/Oct and November at 1700 cents and 1340 cents respectively.

This week’s trades

Aug 2022 19 micron 1740 cents 5 tonnes

Oct 2022 19 micron 1740/55 cents 7.5 tonnes

Total 12.5 tonnes

HAVE YOUR SAY