IT was another tough August start to the wool auction season with a large fall in auction prices and forward trading dormant during the week.

Although it is common for a drop from June to August in the spot auction market — 19 times in the last 25 years — the magnitude of the fall this week took most participants by surprise.

Unfortunately, this year continues to deliver more surprises and shocks across all commodities.

The forward markets remained open over the three-week recess. Volumes were light, but traded at a modest discount — 10 to 15 cents — during the first week. Lack of sellers saw forward prices ease and finished the recess trading 80-90 cents under the close.

Spot physical tenders last week heralded a weaker start, but the sluggish demand and pent up supply saw most Merino qualities come off 150 to 170 cents.

The forward market remained dormant until auctions closed and exporters looked to find offshore demand at the new cash levels. Modest interest was drawn out Thursday and the 21 micron contract traded for September at 1070 cents, which represented flat to cash. This will probably be the pattern over the coming weeks.

There is intermittent demand from processors as they clear some stock. Exporters will look to cover shorts and manage margin providing limited hedging possibilities for growers. It is likely that sellers will need to offer closer to current cash to stimulate activity.

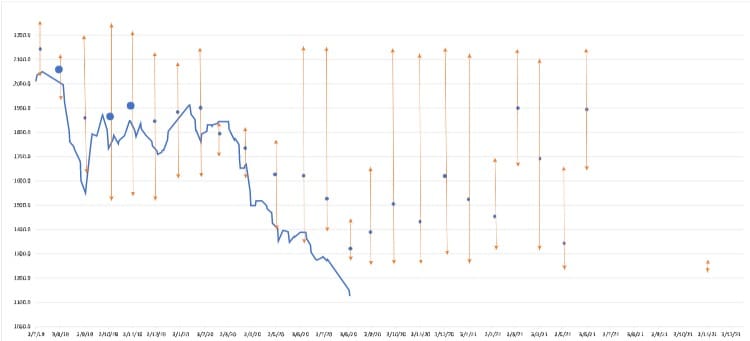

The graph below highlights the difficulty the market has had coping with the volatility of recent times. With the gift of hindsight it is simple to see the value hedging over the year in evening out returns.

Although the range of prices hedged each month was wide the average (represented by the blue dots) tended to settle at a slightly is favour of the seller. This statement holds only if the object is to make a profit on the hedge. Price risk management is about developing a strategy to manage margin that is relevant both in rising and falling cycles.

Anticipated trading levels next week are difficult to estimate but likely to show further easing.

19 micron 21 micron

Aug/Sept 1100 cents 1060 cents

Oct/Nov 1070 cents 1030 cents

Dec/Jan 1050 1010

Trade summary during the recess

August 21 micron 1135 cents 3.5 tonnes

September 19 micron 1250/65 cents 9 tonnes

October 19 micron 1230 cents 5 tonnes

October 21 micron 1165 cents 5 tonnes

November 21 micron 1165 cents 5 tonnes

December 18 micron 1382 cents 5 tonnes

January 21 19 micron 1240/45 cents 10 tonnes

April 19 micron 1245 cents 5 tonnes

Total 53.5 tonnes

HAVE YOUR SAY