ANOTHER strong week on the spot wool auction market helped keep the forward markets in premium as hedging levels broke through some grower’s initial target levels.

There has been much debate as to what level growers will begin to release larger hedge volumes.

With passed in levels around 10 percent, growers are releasing the vast majority of their spot wool to the market.

The forwards traded at a premium throughout the week keeping pace and out stripping the spot index.

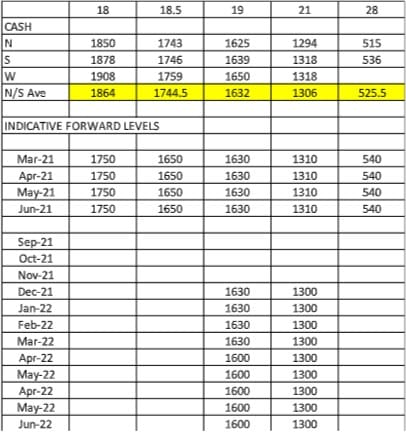

The 19 micron index rose from 1541 cents to close at 1632 cents. Forwards traded April to October from 1600 cents to high of 1655 cents. The same pattern occurred in the 21 micron index, with the spot auction rising from 1223 cents to close at 1306 cents. This generated forward trades March through to October closing on their high of 1310 cents.

Volumes were a little better at 52.5 tonnes, but are still only accounting for 1pc of equivalent auction turnover.

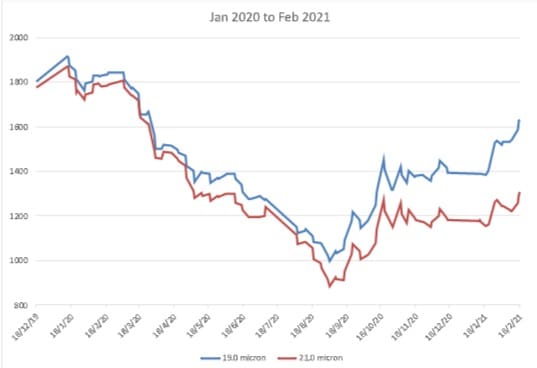

The majority of growers seem reluctant to set hedge levels. This is understandable as the volatility makes setting a fair value target difficult. The graph below not only highlights range of price over the last 14 months, but the varied impact on different microns. For example, the 19 micron index has averaged 1382 cents for the last year, within a range of 996-1844 cents. This would indicate that hedging at 1600 cents-plus is a sound strategy. This is true, but it is also important to look at the longer-term price trends when setting initial and supplementary hedging targets.

![]()

Next week it is 12 months since the cyber attack that halted spot auctions for a week and heralded in “annus horribilis” and the unprecedented health and economic challenges that the world is still grappling with. It put into stark focus how these “Black Swan” events and other demand shocks can negatively impact on enterprise outcomes.

Buyers indicated that the spot auction lacked momentum into the close of Melbourne sales on Thursday, particular in the finer wools. We will probably see a little hesitancy in bidding ahead of next week’s round of auctions.

This week’s trades

March 21 micron 1310 cents 5 tonnes

April 19 micron 1620/1650 cents 9 tonnes

April 21 micron 1305 cents 5 tonnes

May 19 micron 1650 cents 5 tonnes

June 19 micron 1600 cents 2 tonnes

Aug 19 micron 1590 cents 2 tonnes

September 19 micron 1655 cents 12 tonnes

October 19 micron 1600/1650 cents 10 tonnes

October 21 micron 1305 cents 2.5 tonnes

Total 52.5 tonnes

HAVE YOUR SAY