AUSTRALIAN lamb is not expected to immediately flow into the United Kingdom in large volumes under the UK-Australia Free Trade Agreement, according to analysis by the UK’s Agriculture & Horticulture Development Board.

However, the AHDB’s lead market intelligence analyst for livestock, Duncan Wyatt, has indicated there is still some UK concern about the impact of global and domestic conditions that might lead to Australian lamb imports rising to the maximums allowed under the agreement, set to be signed this year.

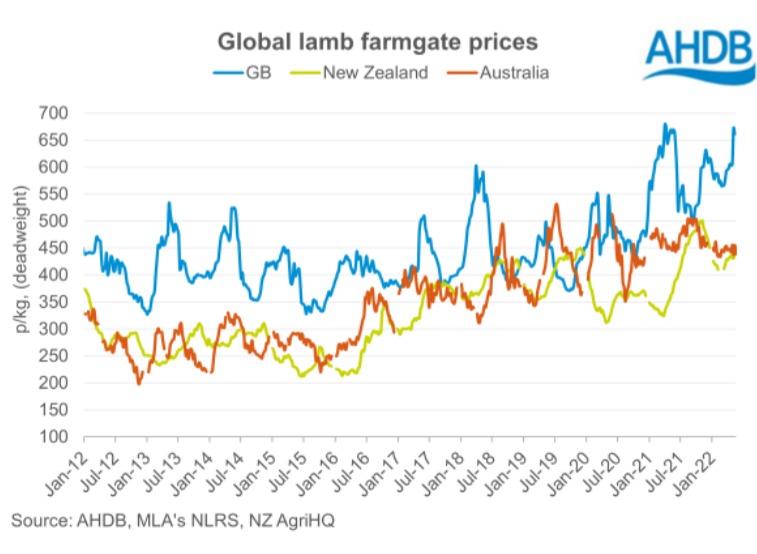

These factors include the difference in farmgate lamb prices between Australia and UK, any further deterioration in the China/Australia trade relationships and improvements in global shipping logistics.

In his recent article ‘Australian lamb, the story so far in 2022’ Mr Wyatt said when the Australia-UK Free Trade Agreement enters into force, Australia will benefit from enhanced access to the UK market. For sheep meat this means a tariff-free volume of up to 25,000 tonnes of sheep meat in the first year, increasing to 75,000 tonnes by year 10, he said.

He said the AHDB considered it was possible under the right conditions that Australian lamb imports might rise to the maximum allowed under the FTA, “but of course it would not be a base case for our expectations.”

“Under normal circumstances we do not expect a huge influx of Australian lamb into the UK at all.

“Any additional volumes that do come, are far more likely to be instead of other trade (probably from the EU), and not as well as other imported lamb,” he said.

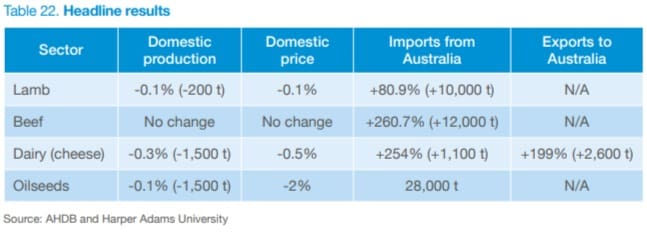

Modelling by the AHDB and Harper Adams University in the report ‘The impact of a UK-Australia free trade agreement on UK agriculture’ has suggested that:

- There will be a large increase in Australian lamb imports in percentage terms. However, this is from a low base, and volume changes are relatively small

- Total UK imports are not expected to increase significantly, with much of the increase from Australia offset by reduced imports from elsewhere.

- Results show that changes in the UK domestic marketplace (production, price etc.) are relatively small.

Mr Wyatt said Meat & Livestock Australia’s February outlook for the Australian sheep sector forecast lamb slaughter to increase by 7 percent to 21.6 million head, with lamb production lifting from 502,000 to 540,000 tonnes and exports expected to increase to 307,000 tonnes, from 283,000 tonnes in 2021.

Since then, he said, in the first three months of the year, 4.97 million Australian lambs have been slaughtered, but in line with the MLA forecast, carcase weights have been heavier.

“Together, this means lamb production is 2pc higher so far in 2022.

“In February, a greater number of lambs was expected to come to market in early to mid-2022, and so production is still set to increase further.”

In the first four months of the year, Australian lamb exports totalled 91,500 tonnes, 9pc higher year-on-year. Within this, exports to the United States have increased by 20pc to 23,300 tonnes, while trade with China has contracted, by 18pc to 19,200 tonnes. Mr Wyatt believes this has been driven by lamb availability, and the wide spread in farmgate price — even allowing for more expensive shipping – between Australia and the UK.

Mr Wyatt said the key caveat to the AHDB modelling results is the assumption that China/Australia trade relations stay the same.

“If the relationship was to breakdown, that could see much more Australian lamb on the global marketplace looking for a home.

“Given the level of tariff-free access proposed in the agreement in principle, there is scope for Australia to increase the amount of tariff-free lamb destined for the UK, even after these results are taken into account,” he said.

Mr Wyatt said the current spread between Australian and GB lamb prices is particularly high, but global shipping constraints mean that markets closer to home retain their appeal. The AHDB puts UK farmgate lamb prices at just over 650pence/kg carcase weight versus around 450pence/kg cwt in Australia and New Zeland.

Mr Wyatt said Australia’s lamb exports to the UK have increased by 50pc year-on-year, to 2600 tonnes, in the period to April, although the UK is still only the 9th biggest market by size for Australian exports in the year to date.

Source: AHDB.

HAVE YOUR SAY