Southern Aurora Markets partner Mike Avery.

WOOL buyers lifted forward market offers as the spot auction delivered its strongest week since June 2021 and the AWEX Eastern Market Indicator rose 42 cents.

The lift was general across all micron ranges with the broader Merinos reaching levels not seen for almost two years.

Forward wool maturities were split evenly across Autumn, Winter and Spring. The real test will come next week. Chinese processors will be returning from their New Year celebrations to a significantly higher market. How this will play out will be interesting.

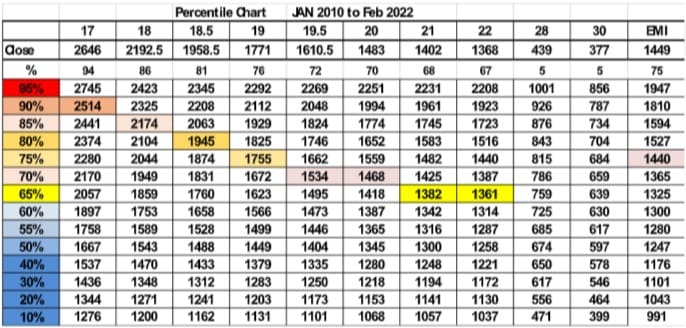

The table below illustrates where current prices are sitting relative to the last decade. Buyers and sellers need respond to try and de-risk their businesses at these higher levels.

The first reaction will likely be a change in the forward curve. The flat curve forward will initially move into backwardation. We are seeing this already with front months trading over the later dated and buyers wary of distant months even at discounts. Finding fair value in these times is always difficult.

We expect an increased participation from growers at the elevated levels as they look to manage their margins going forward. Buyers’ ability to pay up will be dictated by the reaction off-shore to the current momentum in the spot market.

This week’s trades

April 2022 19 micron 1745 cents 4 tonnes

May 2022 21 micron 1360 cents 10 tonnes

July 2022 18 micron 2105 cents 5 tonnes

Sept 2022 19 micron 1720 cents 5 tonnes

Sept 2022 21 micron 1355 cents 6 tonnes

Oct 2022 21 micron 1350 cents 5 tonnes

Nov 2022 17 micron 2405 cents 5 tonnes

Total 40 tonnes

Source – Southern Aurora Markets.

HAVE YOUR SAY