FORWARD wool trading occurred early this week as the high passed-in and withdrawal rates again dominated the physical auctions.

Offshore demand again disappointed, leading to a continued fall in the spot auction market, which lost around 3 percent for the week.

On the forward markets, it was again a case of “first in best dressed”. The majority of trades occurred early in the week, with a small number of growers taking advantage of the cash bids at market out to May 2022. Nine separate maturity months traded from August to May. The 19 micron and 21 micron contracts shared most of the volume, with one lot trading in August for 18 micron.

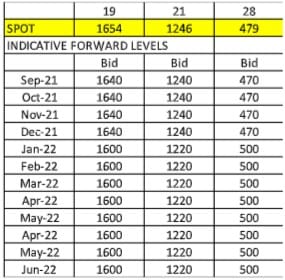

Trades were flat across the curve with 19 micron trading to 1730 cents out to March and 21 micron trading at 1310 cents out to May 2022. Both these levels were around 60 cents above the closing spot cash rate.

Trades were flat across the curve with 19 micron trading to 1730 cents out to March and 21 micron trading at 1310 cents out to May 2022. Both these levels were around 60 cents above the closing spot cash rate.

The outlook for next week is that we will likely see a pullback in the forward market. It will likely present some opportunities around the new spot levels as buyers look to get some cover in what looks to be a reasonably volatile period for the next two to three months.

Where buyers and sellers see fair value is difficult to estimate. Lower auction volumes next week might see short term support and give exporters the confidence to lock in levels around this week close (19 micron at 1655 cents and 21 micron at 1255 cents). If the last months trading is any indication New Year levels may justify a slight premium although not evident just now.

This week’s trades

August 18 micron 1950 cents 5 tonnes

September 21 micron 1290 cents 5 tonnes

November 19 micron 1730 cents 5 tonnes

November 21 micron 1310 cents 5 tonnes

December 19 micron 1730 cents 5 tonnes

December 21 micron 1310 cents 5 tonnes

January 2022 19 micron 1730 cents 5 tonnes

February 2022 19 micron 1730 cents 5 tonnes

March 2022 19 micron 1730 cents 5 tonnes

April 2022 21 micron 1310 cents 5 tonnes

May 2022 21 micron 1310 cents 5 tonnes

Total 55 tonnes

Source – Southern Aurora Markets.

HAVE YOUR SAY