Sheep in drought conditions.

A FALL in Australia’s Farm Management Deposits balance from a peak of $6.6 billion in June 2018 to $5.37 billion at the end of the March 2019 quarter shows the scheme is working as intended, National Australia Bank said today.

NAB Agribusiness customer executive Neil Findlay said the drawdown demonstrates that primary producers are using FMDs to better manage their cash flow through changing market and seasonal conditions.

“FMDs are designed to allow producers to set aside pre-tax income in the good years, which is then available for use in the tougher times.

“Many producers have faced prolonged periods of drought, and associated record water and feed grain prices,” Mr Findlay said.

“The current FMD drawdown, while significant in terms of dollar value, is not surprising when you look at this broader context.”

Hard-hit NSW leading FMD drawdown

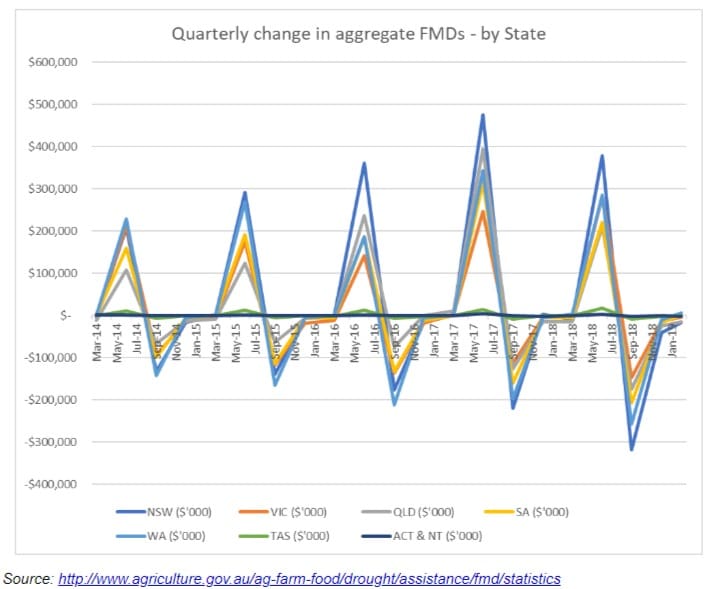

NAB said its data and that from the Department of Agriculture and Water Resources showed that there are higher rates of withdrawal in drought-affected areas, indicating producers are using FMD reserves to bolster their businesses.

“In January 2019, $9.6 million was withdrawn from FMDs by NAB customers in drought impacted areas. As a percentage of total balances, this was almost triple the rate of withdrawals by NAB customers in non-drought impacted areas,” Mr Findlay said.

Across all banks, a bumper 2018 grain harvest saw Western Australia record a $6 million increase in FMD balance from the December 2018 quarter to the March 2019 quarter, which was the highest of all states. Over the same period, New South Wales, Queensland and Victoria recorded $17 million, $14 million and $4 million net drawdowns respectively.

Mr Findlay said the drought has been significant, but it’s encouraging to see that drawdowns have only been a small percentage of the total balance held, even in drought impacted areas.

“This suggests that many producers are saving their FMD reserves for a rainy day, to fund restocking or planting when the drought breaks.

“The FMD scheme is working, and it is a real positive for our industry,” he said.

The bank anticipates that tough seasonal conditions will lead to the typical pre-EOFY flurry of deposits being more subdued this year.

“We also expect to see a larger drawdown of FMDs at the beginning of the new financial year,” Mr Findlay said.

HAVE YOUR SAY