Rabobank analysts Angus Gidley-Baird and Chenjun Pan in Roma, Queensland.

PREDICTED high prices for Chinese pork at retail are expected to lead to increased opportunities for Australian lamb and mutton, according to Rabobank’s China-based senior animal proteins analyst Chenjun Pan.

However, Ms Pan said the opportunities for sheep meat might not be as big as for beef.

The report — New opportunities for Animal Protein in China – Looking beyond COVID-19 and Swine Fever – outlines how African Swine Fever (ASF) and COVID-19 have created great volatility in China’s animal protein market.

This has meant shifts in distribution channels and consumer behaviour that will create new opportunities for meat exporters, according to the report.

In the report, Ms Pan said several major trends are expected to drive future change in the Chinese market, including more diversified consumer groups, increasingly blurred distinctions between various market segments and channels, and a higher demand for convenience and smaller packaging.

Rabobank Australian senior animal proteins analyst Angus Gidley-Baird said Chinese pork supply dropped by more than 20 percent in 2019, and a further drop of 15-20pc was expected in 2020.

“Despite two years of strong imports, the supply drop has been so drastic that pork consumption per capita in China has dropped from 40 kilograms in 2018 to 32.6 kilograms in 2019 and is expected to drop to 28 kilograms in 2020,” he said.

Mr Gidley-Baird said in the coming years – particularly in 2021 – Chinese pork retail prices were expected to stay relatively high, with consumption comparatively low, and this would lead to ongoing opportunities for substitute meats such as poultry and beef.

“As production recovers, Chinese pork consumption will increase again, albeit we do not believe it will return to pre-ASF levels.

“The longer-term opportunities for other proteins will rest on whether they can penetrate into a wider consumer base and establish new dietary habits during this time window before Chinese pork production recovers,” he said.

China’s sheep meat consumption has also increased

Ms Pan said with the reduction in pork consumption from 40kg/capita in 2018 down to an estimated 28kg/capita in 2020, consumption of other proteins have increased – including sheep meat which has increased from 3.5kg/capita to 3.8kg/capita.

“But sheep meat is a little different from beef.

“Sheep meat consumption is more seasonal than beef with higher consumption in winter months,” she said.

“It is also more heavily consumed in northern regions of China.”

Ms Pan believes that sheep meat consumption at home in China might not rise as much as beef due to more limited cooking styles and meal options. Hotpot is one of the main ways to consume sheep meat. However, there are areas of China where sheep meat is much more popular and there are many meal options.

Sheep meat prices in China have risen

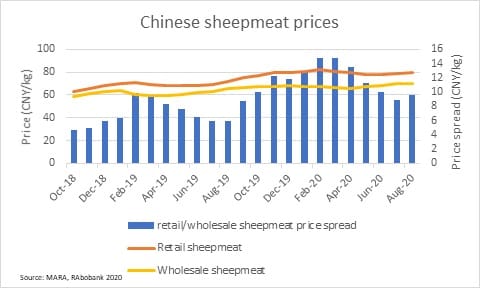

Ms Pan said in the first eight months of 2020, sheep meat retail prices have also increased.

Ms Pan said in the first eight months of 2020, sheep meat retail prices have also increased.

“We have also seen the price spread between retail and whole reach very high levels early in the year which would have coincided with the lockdown periods for China and increased winter consumption.

“The price spread has since declined; however, it still remains higher than this time last year.”

Dietary changes could support more beef

Mr Gidley-Baird said there were signs Chinese dietary patterns were altering in ways that would support longer-term beef consumption growth. And, with static Chinese beef production, further growth of Chinese beef imports was a good opportunity for Australia.

“Beef, which used to be consumed in China mainly in eating-out-of-home channels, is now finding ways to penetrate into home cooking. In the first eight months of 2020, Chinese beef retail prices increased faster than wholesale prices, indicating that demand from retail consumers is increasing strongly.

“In this way, beef is unlocking a vast retail market, albeit gradually, which will support consumption growth in the years to come,” he said.

Mr Gidley-Baird said Australia’s total exports of beef to China had declined by 16pc so far this year (YTD August) due to lower production, export licence suspensions and triggering of the trade agreement safeguard measure.

“However, we have seen chilled beef volumes to China increase 45pc.

“Some of this would be heading into that growing retail channel,” he said.

“Australia’s ability to send chilled product and measures to increase our capacity will increasingly allow us to tap into this growing demand,” he said.

HAVE YOUR SAY